When is the cheapest time to fly to Cape Town? Joburgers will be pleased to know (or perhaps not so much) that it is at 5PM on Sunday evening. The most expensive time to fly is, unsurprisingly, Friday at 4PM.

These are some of the findings from Discovery Bank’s annual survey of its customers’ spending habits for the past year, done with Visa.

Conversely, for Cape Town to Joburg flights, the cheapest time is Wednesday at 9PM (the same goes for Durban to Joburg) and the priciest time is at midday on Sundays. From Durban to Joburg the most expensive is at 4PM on Sunday afternoon. Joburg to Durban is at its cheapest at 6AM on Sunday – good luck with that – while at its costliest at 1PM on Friday.

The data was compiled not just from Discovery Bank’s customers, but from 60-million global credit cards which made 13-billion transactions through Visa’s “vast global repository,” said the bank’s CEO Hylton Kallner. This gives a snapshot of how global economies in 2023 had to navigate a “post-pandemic revival, framed by persistent inflation and high interest rates”.

These macro-economic challenges “pushed up the cost of living” and demonstrated South Africa’s “economic resilience” through “more stable spending patterns,” he said of the SpendTrend24 report’s findings.

Apart from Johannesburg, Cape Town and Durban, data was analysed from 11 other global cities: five from emerging markets (Accra, Lagos, Rio de Janeiro, Sao Paulo and Ho Chi Minh in Vietnam) and six in developed countries (Barcelona, Lisbon, London, Los Angeles, San Francisco and Sydney).

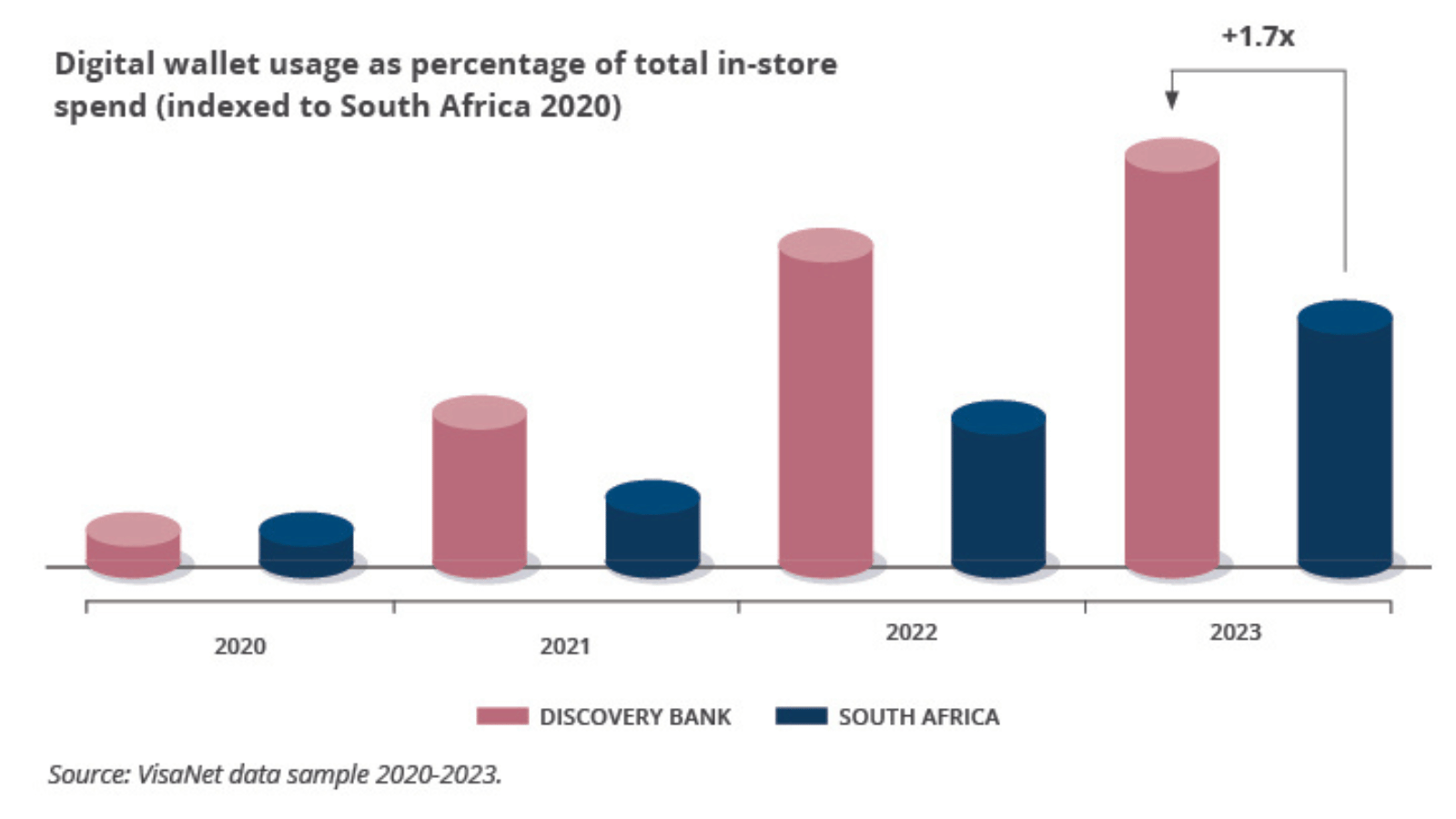

While the study shows a “growth in online and digital transformation,” says Visa South Africa country Manager Lineshree Moodley, “South Africa stands out as a leader in the global shift towards digital wallets, online purchases and contactless payments”. Indeed, most Stuff readers will not be surprised to learn that we tech-savvy Saffas are using our smartphone wallets to pay instead of physical cards in actual wallets at the same adoption rates – or even “surpassing” them – as international cities.

Online shopping also grew five times faster in 2023 than shopping in-store. “South Africans are increasingly shopping online, surpassing other emerging market cities and keeping pace with developed ones,” the report found.

But what are actually we buying?

According to TrendSpend24, groceries, retail, travel and fuel make up nearly two-thirds of what we South Africans spend our money on. In emerging markets – that’s us in the Global South – most of our budget goes to essentials like groceries and petrol, with less spent on the non-essentials like travel.

The average grocery spend in South Africa in 2023 grew by 8%, double the 16% increase the year before. This was caused by last year’s bogey – inflation – with high food inflation rates of 12% and 11% for the last two years respectively. Grocery spending did not grow in the mass market, meaning most people spent less on food and more of their “disposable income being used to repay debts, due to higher interest rates”.

Our favourite shopping apps – used mostly on a Monday – are Checkers Sixty60, Pick n Pay’s asap! and Woolies Dash – which are exactly the same as our favourite stores to visit (preferably on a Saturday).

Takeaways and eating out only grew by 8% last year, down from the post-pandemic bounce of 28% in 2022. Interestingly, our favourite online takeaways are from Mr D, Nandos and Uber Easts, while our favourite places to eat or pick up food are at KFC, McDonalds and Spur. Our favourite day for takeouts is Friday, while most eating-out dining occurs on Saturdays.

Read More: Go green with us, says Discovery as it unveils new renewable power offerings

Globally, travel has returned to where it was before the pandemic but, not surprisingly, at a “higher cost”. You can’t blame Discovery Bank for pointing out its customers saved themselves R670-million through its discounted rates on flights, car hire and accommodation; nor that its clients earned R300-million back in Discovery Miles for eating healthily.

You will also not be surprised that its patriotic cardholders increased their international travel to France last year – by 6% in terms of all travel and by 3% from the year before – for that small sporting event called the Rugby World Cup.

One of the key findings – pleasingly – is how the “benefits and increased security” of digital payments – both through digital wallets and online purchases – have been driving rapid adoption around the world. “South Africa benchmarks well against global counterparts, with an impressive nine percentage point increase in digital wallet usage over the last year.”