As any gamer and techie will tell you, there’s nothing like escaping to planet rAge. And luckily, we don’t have long to wait. Gallagher Convention Centre will be the site of awesome, with South Africa’s award-winning go-to mega event for video gaming, technology, esports, geek culture and digital entertainment taking place on 9-11 December. And of course, Incredible will be there to kit you out with incredible PC, console gaming, digital lifestyle gear and more. State-of-the-art tech, incredible rAge exclusive deals, plenty of freebies and competitions – you definitely don’t want to miss this! For starters… Immerse yourself in 250…

Author: Sponsored Post

Between rising interest rates and petrol prices, stellar cost-of-living increases, and a dire lack of electricity, South Africans may feel like they legitimately have a lot to complain about right now. But the one thing that we certainly can’t criticise is the quality of our banking and financial services. In fact, when it comes to digital banking advances, like convenient, secure, and contactless payments, South Africa is nothing less than a world leader. It’s a valuable position to be in. After all, the payments ecosystem has a vital role to play in unlocking the full economic potential of the country…

With a history of innovation that began in 1925, Shure has turned a passion for making great microphones and audio electronics into an obsession. Shure continues to set the worldwide industry standard for superior and reliable products. Podcasting or recording on a budget, the MV7X has been designed with podcasters and vocalists in mind, using the same form factor immortalized by our legendary SM7B. Connect directly to almost any audio interface via XLR and you’ll soon be recording with the quality audio that you’ve come to expect from Shure. How it works Many great podcasts are recorded in bedrooms and…

The one thing that has become increasingly clear over the last few years is that Health is Wealth. This festive season, why not invest in the health of your loved ones by helping them to be better informed about their wellness and make moves that matter to their health with the new Fitbit health and fitness wearables. Fitbit devices are available online and in stores across major retailers in South Africa such as Takealot.com, Sportsmans Warehouse, Cape Union Mart, Total sports, Incredible Connection, Makro, E-Bucks, and FNB. Approaching Health & Wellness based on insights with Fitbit Sense 2 Fitbit Sense…

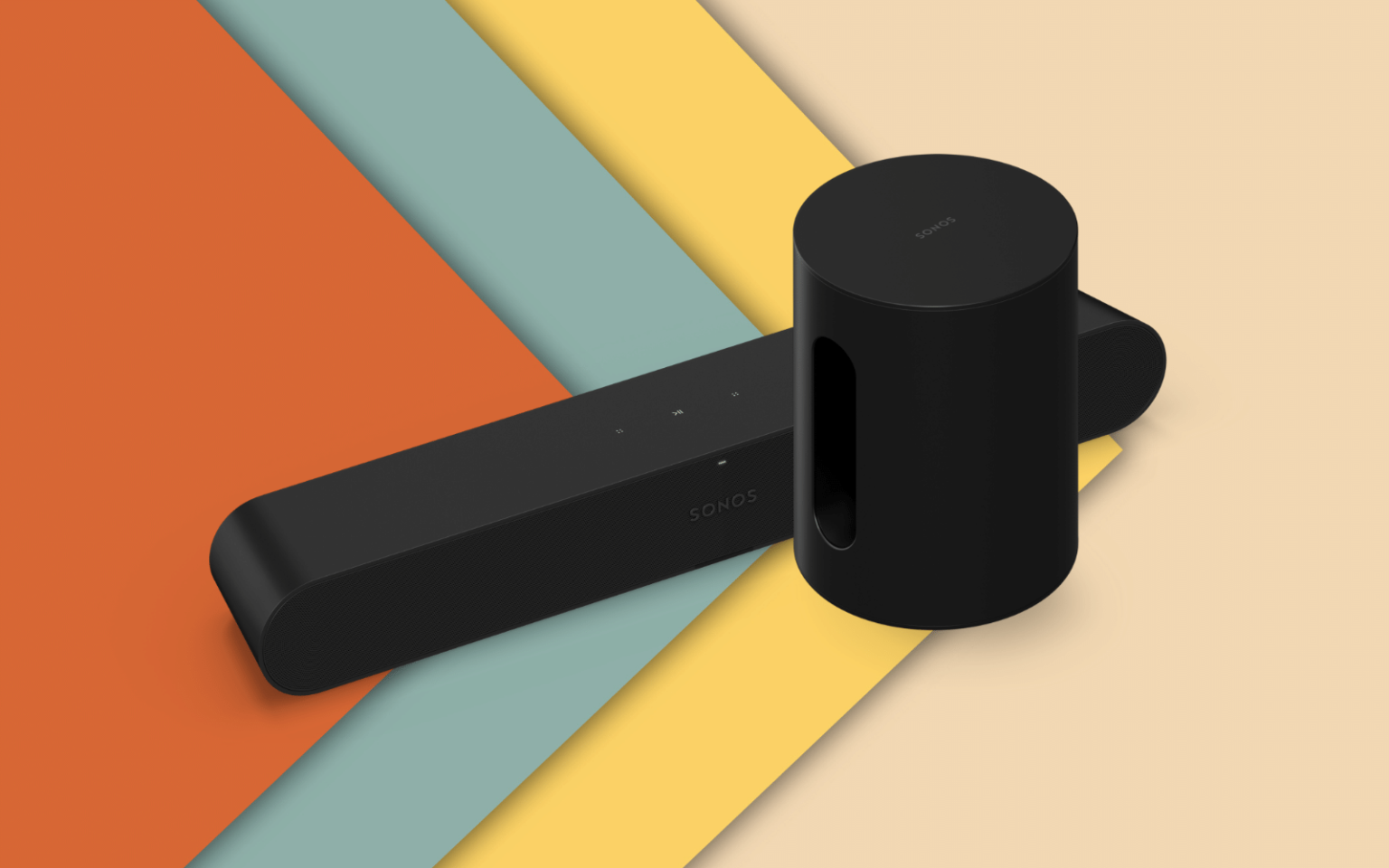

Feel immersed in home cinema and music. The subwoofer (Sub Mini) delivers bold yet balanced bass and lets the soundbar (Ray) concentrate its power on crisper high and mid frequencies. Easily set up and connect both products over WiFi using the Sonos app and sync your TV remote for streamlined control. Sub Mini: Place it anywhere in the room, breeze through setup with help from the Sonos app, and experience richer, more immersive sound without any buzz. “Subwoofers aren’t just for boosting explosions and action scenes – Adding Sub Mini to your system enhances the low frequencies across music, film,…

If you’ve been waiting all year to get your hands on some incredible tech, the wait is over. Black Star November and Black Star Friday at Incredible mean you’ll find the best deals on everything from computing to gaming, audio-visual to wearables, and office appliances to smart tech. And you get a whole lot of extra value-added services thrown in for good measure. Affordable Apple From saving R2,000 on the slick and lightweight MacBook Air 13in to saving R2,500 on the powerful MacBook Pro 16in, if you’re in the market for a Mac, Incredible is the place to go. 3…

Save up to 40% on your favourite HUAWEI products this Black Friday. The biggest shopping time of the year is here. Get ready to shop till you drop with HUAWEI this Black Friday! This includes the latest smartphones and laptops that can be purchased for yourself or gifted to someone special. Want to see what is on offer? Simply visit the HUAWEI online store or pop into selected retailers and be spoilt for choice with incredible savings on some of HUAWEI’s best-selling products. Great savings on selected smartphones For customers who like premium smartphones that offer an exceptional user experience…

OPPO is bringing its Reno8 Pro handset to market and it’s not coming alone. Leveraging performance upgrades from chipmaker MediaTek, the Reno8 Pro will pack the new MediaTek Dimensity 8100-MAX processor at its heart. This is a bigger deal than might be immediately obvious. In recent years, MediaTek has made serious strides in the mobile processor space. Going from the MediaTek Helio range of 4G processors, and right up to the launch of MediaTek Dimensity chipsets with integrated 5G, MediaTek has come a long way. And it’s bringing OPPO along with it for this latest innovation. Mutual benefits Or, rather,…

There are few sporting events as exciting as the FIFA World Cup. 32 international teams play 64 matches in a bid to find out which country fields the best players on the planet. This year South Africans are in for an even better experience. Each of the 64 matches being broadcast in the country by DStv will also be available in 4K. If you own a 4K screen of any description, you owe it to yourself to check out the football action in the crispest, clearest format ever broadcast in South Africa. But, before you get to that point, it’ll…

Samsung Electronics Co., Ltd. recently unveiled its latest gaming screen lineup at Gamescom 2022 in Cologne, Germany, which included the groundbreaking Odyssey Ark and the Odyssey G70B and G65B. The Odyssey Ark, announced last month, is the 55-inch 1000R curved gaming screen, with a 165Hz refresh rate, 1ms response time (GtG) and all-new Cockpit Mode. “As the world’s largest gaming event, Gamescom represents an opportunity for Samsung to showcase our latest gaming innovations that will deliver the incredible future of gaming to player communities around the world,” said Hyesung Ha, Executive Vice President of Visual Display Business at Samsung Electronics.…