Standard Bank, wasting no time in complying with the Department of Home Affairs’ (DHA) wishes, has confirmed the phased rollout of Smart ID services at several of its branches dotted around the country. Better yet, the South African bank will waive any convenience and logistics fees for all its customers during the initial launch.

Take it to the Standard Bank

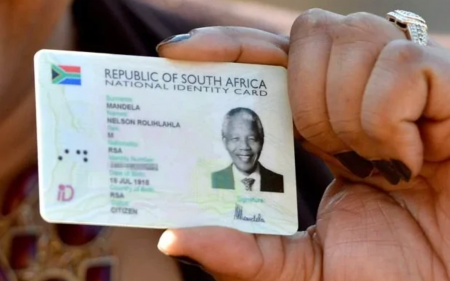

Customers will still have to whip out their wallets to cover the standard DHA application fee of R140. The new branches, kitted out with DHA powers, will offer both first-time application and renewal services at launch. At the time of writing, Standard Bank has only confirmed Smart ID services, with no word on passport applications.

“Our focus is on removing friction for clients, not adding to it. That is why, during our launch phase, customers will pay only the Home Affairs fee, while we work closely with the department to scale a reliable, technology-enabled service across our branch network,’ said Marius Le Roux, head of fraud operations, client experience, and risk execution.

The branches involved in this phased rollout include the Rosebank, Maponya Mall, and Westgate stores — and join the bank’s other branches already capable of providing DHA services. After the trial phase, it hopes to have as many as twenty new branches running DHA services by the end of 2026. It also hopes to roll out a digital application service via its ‘digital banking channels’ at a later date, greatly expanding the service nationwide.

Those twenty branches are only a small part of a much larger game for the DHA. In a bid to make passport and smart ID services more accessible to everyone, the Department aims to have as many as 1,000 branches participating in the services by 2029.