Here’s yet another Eskom update that’s bound to garner more than a few eye rolls. At a public forum yesterday (27 October), the power provider discussed its updated Transmission Development Plan (TDP). The takeaway? South Africa needs at least 53GW of new energy within the next ten years to maintain the grid and keep the economy afloat.

That’s… a tall ask. Consider the Medupi and Kusile power stations. Eskom has spent the last fifteen years trying (and failing) to add 9GW of generating power to the grid.

This won’t be cheap

There is a slight consolation here. Of the projected 53GW Eskom needs, this “includes the current deficit of between 4000MW and 6000MW.” Whew.

The energy will (hopefully) come through new sources, particularly in the wind and solar industries. But first, Eskom needs a better transmission network. Should nothing stand in the plan’s way, Eskom requires an additional 14,200 “extra-high voltage lines and 170 transformers by 2032.”

“Accommodating this increased generation capacity means that a reliable and adequate transmission system is required to integrate and dispatch this new capacity to the load centres across the country,” Eskom said.

As for the shorter term, Eskom needs 2,890km of extra-high voltage lines and 60 transformers by 2027. This requires an investment of around R72.2 billion to complete. “This requires that some challenges beyond Eskom’s full control, such as the lead time to obtain servitudes, among other relevant authorisations, as well as the resource capacity in the country, be urgently addressed,” it added.

Read More: South Africa has plans to build EVs and get rid of 10 Eskom Power Stations

Of the R72.2 billion allocated to the next five years, R50.8 billion is being funneled into capacity expansion with the remaining R21.4 billion needed to upgrade “the existing asset base and procurement of production equipment.”

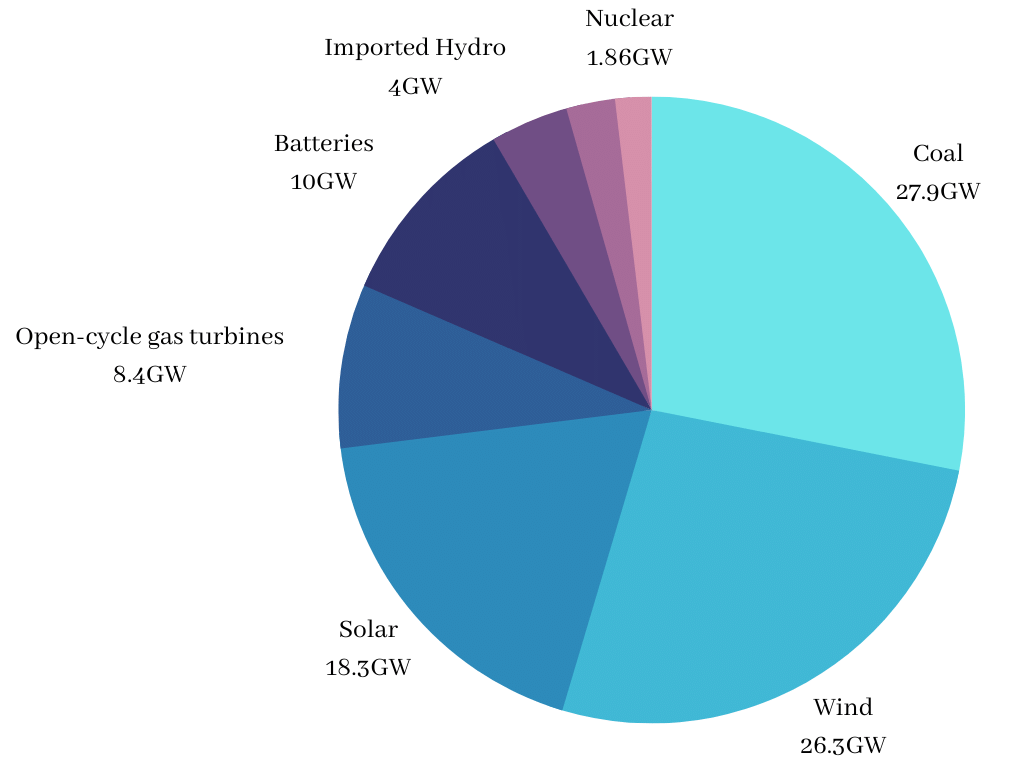

Eskom’s Managing Director for Transmission, Segomoco Scheppers predicts that the country will have close to 97.4GW of power available by 2032, spread across a number of different sectors. See the pie chart below of the expected energy pool:

It’s easy to make plans, but when Eskom is involved, following through is a bit more of a tall order.