It cannot be denied, investing in cryptocurrencies like Bitcoin and Ethereum has proven to be a profitable choice. Even after the most recent crypto market pullback, the overall cryptocurrency market has significantly outperformed other investments. As a result, many investors have shifted their focus to the crypto space and made a point of including cryptocurrencies in their portfolios.

The problem is that the crypto market has been dominated by speculators. Those who have purchased individual cryptos in hopes of making a quick buck instead of taking a professional and more sensible approach to crypto investing. Financial advisors and wealth managers plan to invest in cryptocurrencies the same way they invest in stocks — by investing in a low-cost, diversified basket, or bundle, of the top-performing cryptocurrencies.

The idea is to invest across multiple cryptos so that a drop in prices of one does not significantly reduce your overall portfolio’s profitability. This strategy captures the essence of investment portfolio diversification and is the bedrock of investing in every other investment category.

Every investor’s primary goal is to maximise profits while minimising risks, which is why we set investment goals, diversify our portfolios and employ a variety of strategies to capitalise on market trends – like the growth of a certain country, market, asset category or sector.

How do we start?

Most people are too focused on being on the right train but never stop to consider if they are even on the right track.

There has been a lot of hype around individual cryptocurrencies but have you thought about the bigger picture — exposing yourself to different sectors within the crypto space. Just like you do when investing in the technology, resources, or property sectors of the JSE.

Wait, there are sectors in the crypto market?

Yes, there are clear and very distinct sectors within the cryptocurrency market that we can invest in. The most established sectors are the:

- Smart contract platforms,

- Payments coins, and

- Decentralised Finance (DeFi) applications.

Remember, not all cryptocurrencies are trying to become digital money. Only the payment coins are trying to do this. The term cryptocurrency can be confusing for this reason as it insinuates that all blockchain-based projects are trying to create a new form of value transfer. It’s for this reason why you’ll often hear die-hard crypto fans talk about cryptoassets instead.

Let’s forget about Solana, Cardano, Polkadot and all the rest for a minute and take a step back.

Many experienced investors use what they like to call a “top-down” approach when considering what to invest in, so let’s start there.

Traditionally a “top-down” approach is exactly what it sounds like. We take the whole investment market and work our way down into industries/sectors of the market and then to the individual stock (or, in this case, crypto) we wish to invest in.

For the world of crypto, if we start by defining the “top-down” structure we’d need to start by asking ourselves some important questions:

Which of these sectors is performing the best?

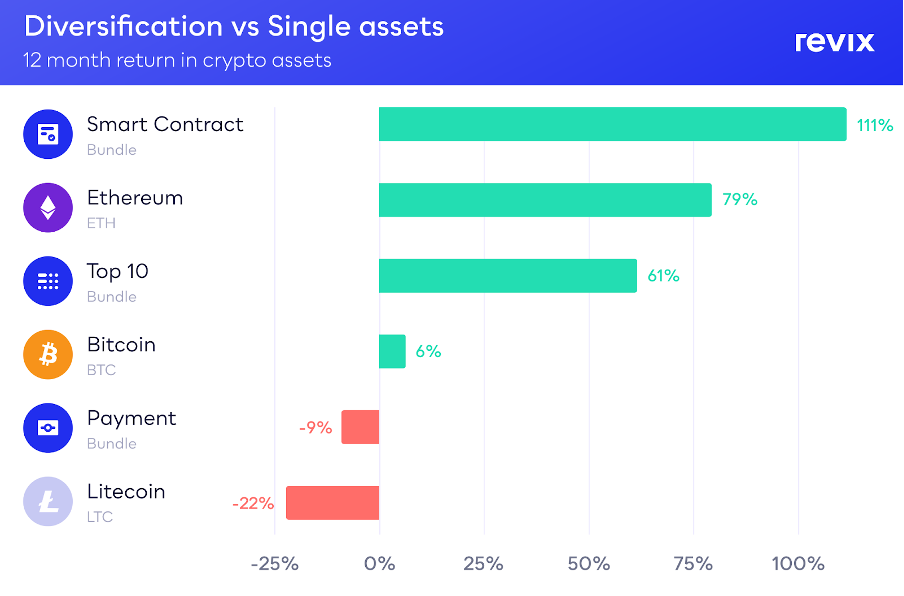

Over the past year, the smart contract sector has been drawing the attention of the world with the sector producing 12-month returns of +111%. This is primarily driven by the fact that smart contracts have started to pave the way forward for many other blockchain-based applications like DeFi and NFTs.

DeFi comes in next with an overall sector performance of +33% over the last year.

The payment sector is in third place and is starting to gain momentum as more names like PayPal, Visa and Google start to get involved with decentralised crypto based payments and try to incorporate blockchain technologies into their offerings.

Let’s dive into the Smart contract sector

Smart contracts have become a game-changer in the cryptocurrency market and have created one of the biggest sectors in crypto, DeFi.

A smart contract refers to a computer programme that lives on the blockchain.

These programmes automatically run or execute specific actions when predetermined conditions are met. Think of it the same way you put money into a vending machine to buy a product. The seller sets out the conditions under which the item is released. The buyer pays what is required, after which the item will be released to them. You get your soft drink, and the seller gets their money, no need for a third party to see if the conditions have been met or monitor the transaction.

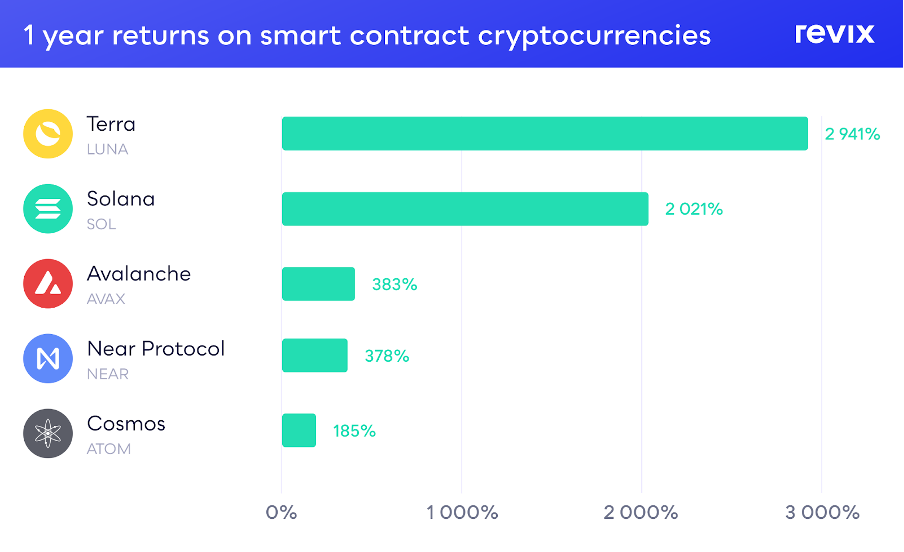

Smart contracts are taking the crypto space by storm as they are put to more and more use. Popular names like Terra (+2 941%) and Solana (+2 021%) have produced extraordinary returns over the last year. Even Cosmos, which is sitting at the bottom of this chart, boasted a (+185%) return that was able to beat the S&P 500 (+18.18%) and the JSE Top 40 (+18.39%) by a landslide.

Payment coins

Payment coins

Payment coins are cryptocurrencies looking to revolutionise money transfers and how value is transferred using their own blockchain and crypto coin as means of payment. A blockchain’s ability to transfer value over the internet in an instant and unstoppable way led to the creation of coins such as Bitcoin (BTC), Ripple (XRP), Litecoin (LTC), Stellar (XLM) and Bitcoin Cash (BCH).

Money in its simplest form has three basic functions to fulfil: It should be a medium of exchange, unit of account, and store of value. Payment coins are seen as digital money as they can achieve these three functionalities just as well, if not better, than fiat currencies.

Payment coins not only meet the criteria to be considered digital money, but they can also be seen as hedges against inflation — something fiat currencies struggle to do. If you take a look at the annualised five-year return of Revix’s Payment Bundle, which provides exposure to the largest Payment focused cryptocurrencies, it is up +150%. This can certainly be seen as a major benefit of payment coins over traditional fiat currencies.

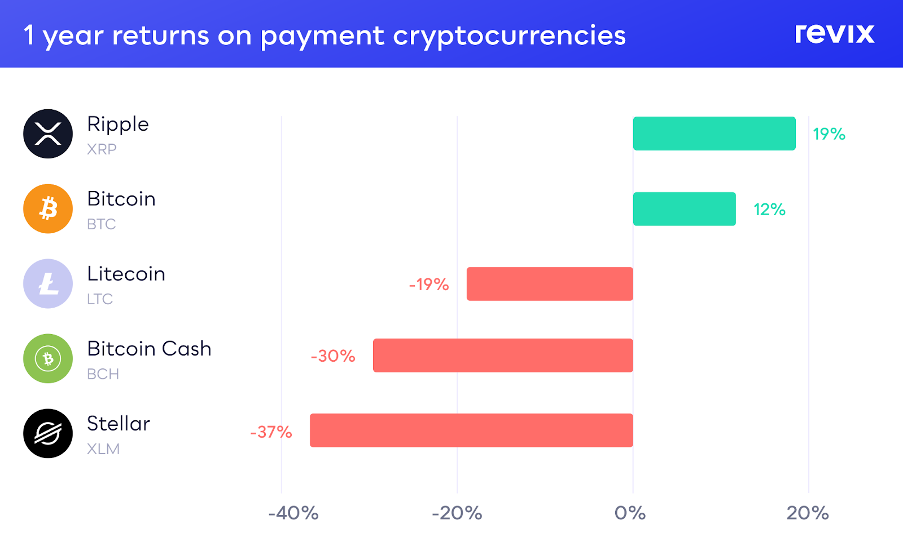

The two winners in this sector are Ripple and Bitcoin, with +19% and +12% returns, respectively.

The two winners in this sector are Ripple and Bitcoin, with +19% and +12% returns, respectively.

Although this sector’s recent performance may be worse than others, the fundamentals behind each cryptocurrency project remain the same — the world has an obvious and growing need for better payment systems. For an investor with a long term view, the recent drawback in this sector’s performance may signal an excellent buying opportunity.

DeFi

DeFi is a subsector of the cryptocurrency industry challenging traditional financial institutions. This includes banks, insurance companies and stockbrokers, as well as where entrepreneurs build semi-automated trading and lending systems atop blockchain networks.

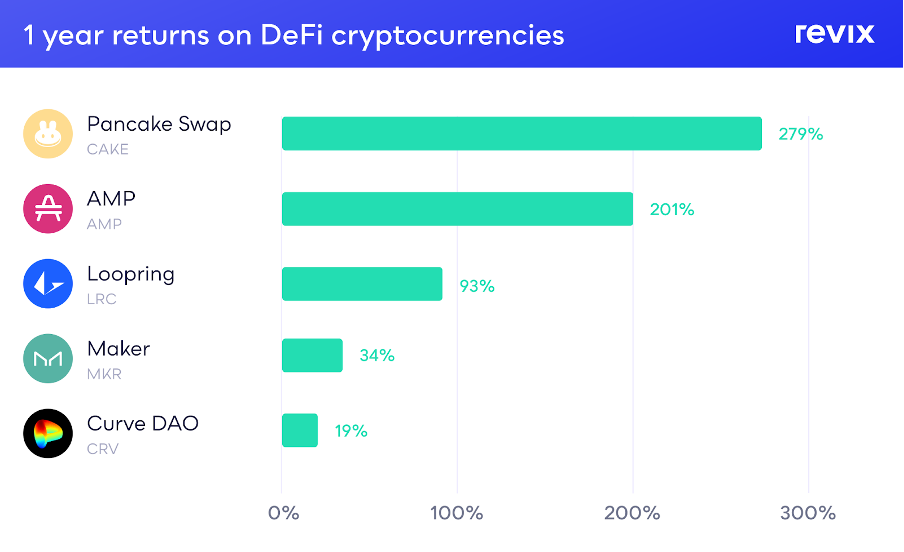

2021 brought in a new era of DeFi innovation and constant building. The returns of DeFi tokens held strong, with the likes of CAKE up by +278% for the year.

While DeFi is a revolutionary sector, it is still finding its feet as it tiptoes through regulations. Perhaps this is why it hasn’t quite rivalled smart contracts this year.

While DeFi is a revolutionary sector, it is still finding its feet as it tiptoes through regulations. Perhaps this is why it hasn’t quite rivalled smart contracts this year.

So do crypto sectors beat the standalone cryptocurrencies in each sector?

Remember, the above sectors were based purely on winners. While these returns might look better than an index, you would’ve had to have the foresight and knowledge to pick these winners one year ago and hold onto them. An index provides a way to still hold the winners while automatically reducing your volatility and overall investment risk in an already high-risk category.

We can see from the above graph that, in each sector, the index beats its single cryptocurrency counterpart.

We can see from the above graph that, in each sector, the index beats its single cryptocurrency counterpart.

- Revix’s Smart Contract Bundle outperformed Ethereum by over +30%

- Revix’s Top 10 Bundle outperformed Bitcoin by over +55%

- Revix’s Payments Bundle outperformed Litecoin by over +10%

All while reducing the investor’s volatility and keeping them automatically up to date with the fast-moving world of crypto.

But where can I get exposure to these crypto sector Bundles?

Cape Town-based crypto investment platform Revix is backed by JSE listed Sabvest and offers something unique to you, the investor. You can either invest in standalone cryptocurrencies — like Bitcoin, Solana, Ethereum, Uniswap, Cardano and more — or set yourself apart from the rest by investing in ready-made diversified “Crypto Bundles” which look similar to ETFs.

Their crypto Bundles enable you to effortlessly own an equally-weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. Revix currently offers three Bundles, namely the Top 10 Bundle, Payment Bundle and Smart Contract Bundle.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top 5 payment focused cryptocurrencies looking to make payments cheaper, faster and more global.

The Smart Contract Bundle provides equally weighted exposure to the top 5 smart contract-focused cryptocurrencies like Ethereum, Solana and Polkadot that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its OS operating system.

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform enables anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more visit www.revix.com.