In a press release today, FNB announced that its customers can now use their virtual cards with participating digital wallets like its own tap-to-pay and scan-to-pay features, Apple Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

Since the beginning of the year, 500,000 virtual cards have been activated and used to spend over R1 billion rand collectively. So it seems natural that FNB adds the feature to all forms of digital payments.

Chris Labuschagne, FNB Card Chief Executive says, “Our approach is to support our individual and business customers with a wider choice of contextual payments solutions via our digital platform.”

FNB says why swipe when you can tap

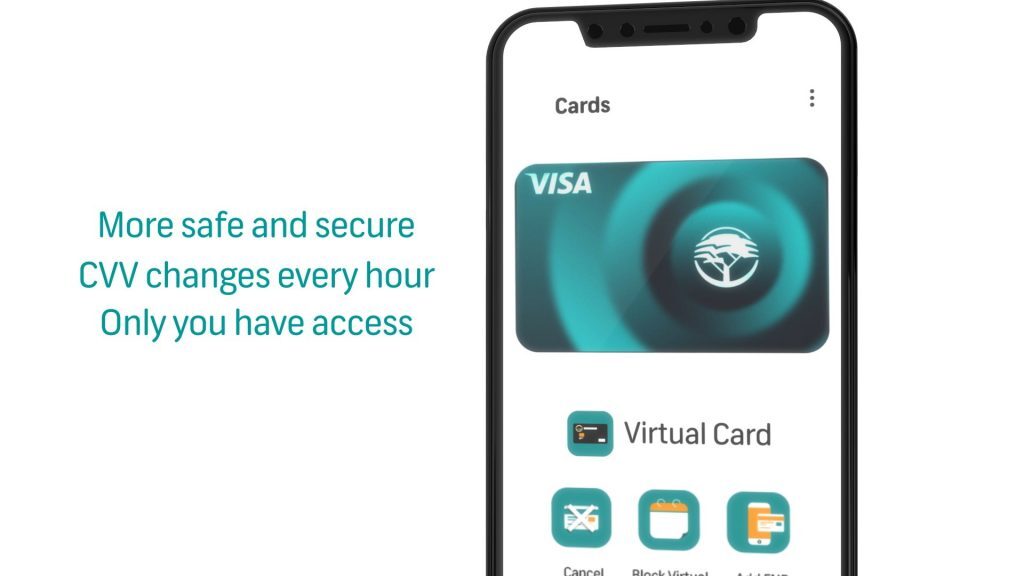

The need for virtual cards grows stronger as we edge closer to an always-online, ever-connected world. Virtual cards use a dynamic CVV number which makes them much more secure than physical cards.

Now, customers can create a virtual card to link to the various contactless payment methods available to them. You can even create one virtual card per digital wallet so that in the unlikely event one account’s details are compromised your bank balance is saved from running up large bills.

That’s not to mention the convenience of not having to carry cash around with you or relying on only one physical card because we all know if it is lost or stolen it can be quite a mission to replace.

Jason Viljoen, FNB Head of Digital Payments says, “The expansion of our FNB Pay enabled suite of digital wallets for contactless transactions is crucial to helping customers minimise their reliance on cash and having their physical card on hand.