As the world and, more specifically South Africa attempts to usher in a new age of EV adoption, President Cyril Ramaphosa has signed into law new powers that will unlock a massive 150% tax incentive for electric and hydrogen-powered vehicle manufacturers in the country, according to Bloomberg (paywall).

Going green is hard, apparently

The idea, of course, is to bolster the efforts of EV manufacturers already operating within the country, and ultimately attract new ones, thus leading to a larger EV market locally. The passing of this new law – set to come into effect as soon as 2026 – has attracted interest from Chinese automakers, three of which have reportedly already signed NDAs with the Automotive Business Council, said its CEO Mikel Mabasa.

“With good government policies we will attract new investment, we will increase and retain investment,” Mabasa said in an interview on Friday.

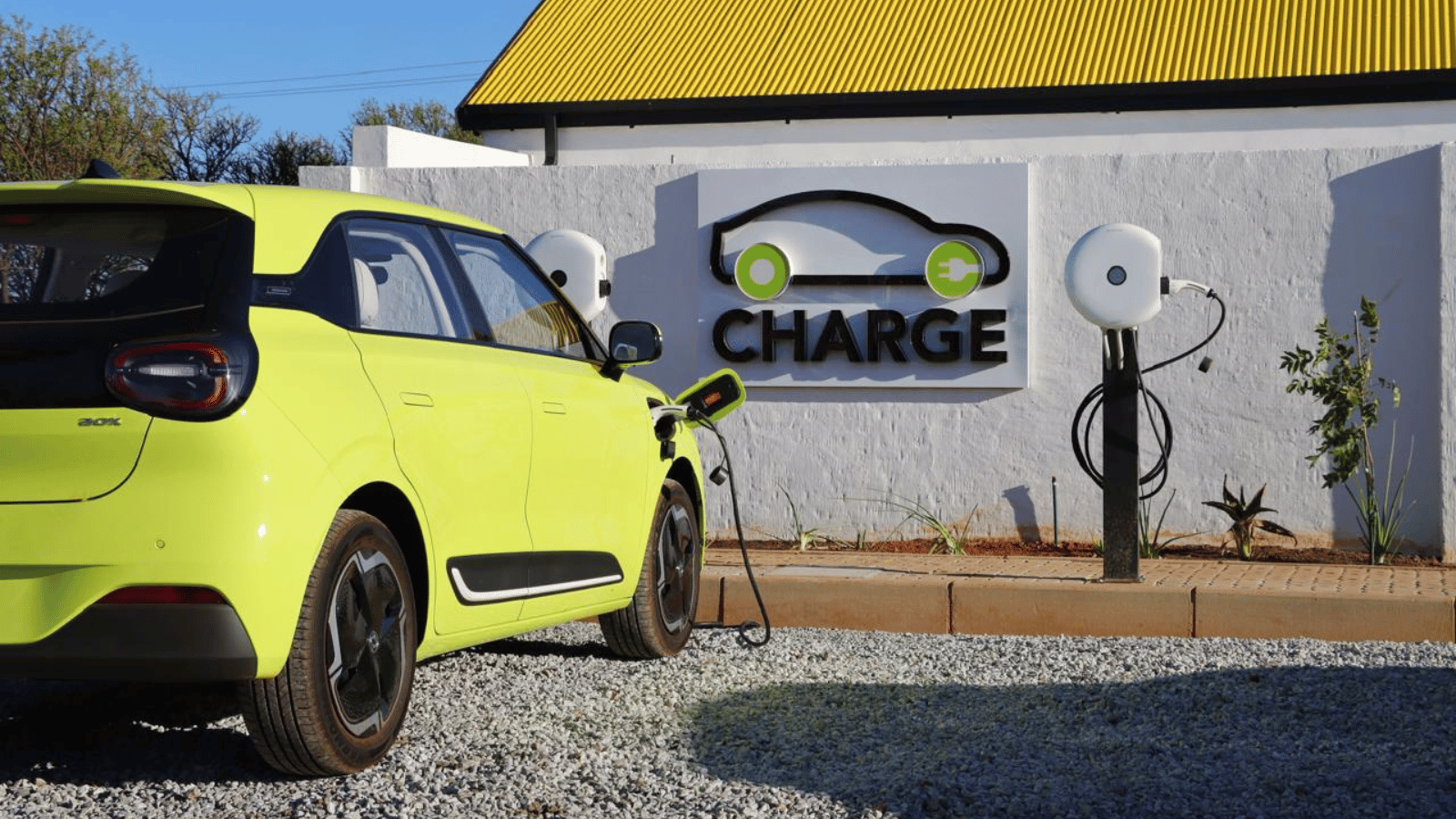

By the time the new tax incentive comes into effect in 2026, these manufacturers can “deduct 150% of the cost of buildings and equipment used primarily for producing electric and hydrogen-powered vehicles” from their taxes, according to South African company Zero Carbon Charge (CHARGE) in a press release. This, however, is still not enough.

“While this measure is expected to boost local manufacturing, CHARGE emphasises that the South African government must address the barriers that hinder EV adoption and promote the development of charging infrastructure,” it said.

Read More: Avert your eyes: the first petrol price predictions for February 2025 are here

Charge, which is currently developing a network of off-grid EV charging stations around the country, is campaigning to have the rather high import duties on EVs in South Africa – currently at 25% compared to the 18% duties enforced on traditional combustion engine vehicles — reduced. These higher prices are counter-intuitive to the new adoption strategy with higher prices in place for residents.

That’s on top of a lack of support for building a stable charging network to support the influx of EVs expected to be on the roads within the next decade or so. “More support is needed to minimise the significant regulatory barriers hindering the expansion of critical charging networks,” it continued.

This disdain for a solid plan to boost the electric vehicle industry in South Africa is echoed by Mabasa, who categorically states that the tax amendment “cannot and will not on its own be sufficient.”

“If government is not supportive the industry will die,” he said.