FNB’s eBucks Rewards programme is undergoing major changes this August; including a simplification of its own rules and better yet, a greater yield of those rewards. Specifically, it’s focusing on the fields of fuel, grocery and travel, making it easier for customers to claim those rewards.

The bank said the new adjustments will launch on 1 August 2023, and run until 31 July 2024. Johan Moolman, eBucks Rewards CEO, mentions that the incoming changes “includes moving our eBucks double-up earn on fuel from quarterly to monthly, increasing grocery benefits to cushion customers against the high cost of living, introducing more family banking rewards, and significantly enhancing our travel experience and benefits.”

Engenics (AKA eBucks fuel rewards)

Of all the changes FNB is bringing forth, the ones involving its fuel double-up rewards programme are the most interesting. With South Africa being what it is, it’s likely that we’ve only seen a glimpse of the wrath the Department of Energy has in store for the country in terms of fuel price increases. Sure, we might get off easy in July (sorry diesel drivers), but it likely won’t last.

The first change involves eBucks’ Engen double-up fuel rewards, with FNB dolling out the reward amounts every month instead of quarterly. Customers can also receive “up to” R2/l on fuel for having FNB Car Insurance on their vehicles, and an additional R2/l if their car is financed with Wesbank and they’re a Private or Premier client. FNB’s lower-tier clients will also get a reprieve, though a smaller one. You can check the account-specific rates in the summary at the bottom of this article.

The eBucks penalisation system is also receiving a major change. Previously, it would often disqualify customers from the double-up fuel rewards (which could net you as much as R8/l) if they purchased fuel from another station that wasn’t Engen. Even if a customer only bought goods from the station and not fuel, and the card machine in use wasn’t of FNB design. FNB required those customers to send pictures of their till slips as proof, a headache for those affected.

Now, customers on FNB’s Premier, Private or Aspire accounts will not be penalised from qualifying for double-up rewards if they choose another station to purchase fuel or goods. Instead, they will just not earn eBucks for that fuel, according to MyBroadband.

To qualify for the R8/l eBucks rewards when filling up at (participating) Engen stations, customers must:

- Use their FNB Virtual Cards

- Have an active vehicle finance agreement with WesBank (or Toyota Financial Services)

- Have your vehicle loaded on nav> Car (under “My Garage”)

- Have FNB Short Term Comprehensive Car Insurance

Licence disc payments and getting a Lift

In light of a recent partnership between FNB and Lift, customers (regardless of their eBucks rewards level) will be offered a “generous” 25% discount when booking a flight with Lift Premium (a fancier way of saying Business Class) when using eBucks Travel on the FNB or RMB Private Bank apps. Oh, and you’ll receive a free Slow Lounge visit, too. If you’ve seen the inside of one of those, you’d know it’s worth it. And hey, free is free.

Those same customers will have access to “upfront discounted prices” when purchasing flights through the apps mentioned above.

Possibly the coolest addition is the ability to let customers pay for their car licence discs with eBucks on the FNB app through nav> Car.

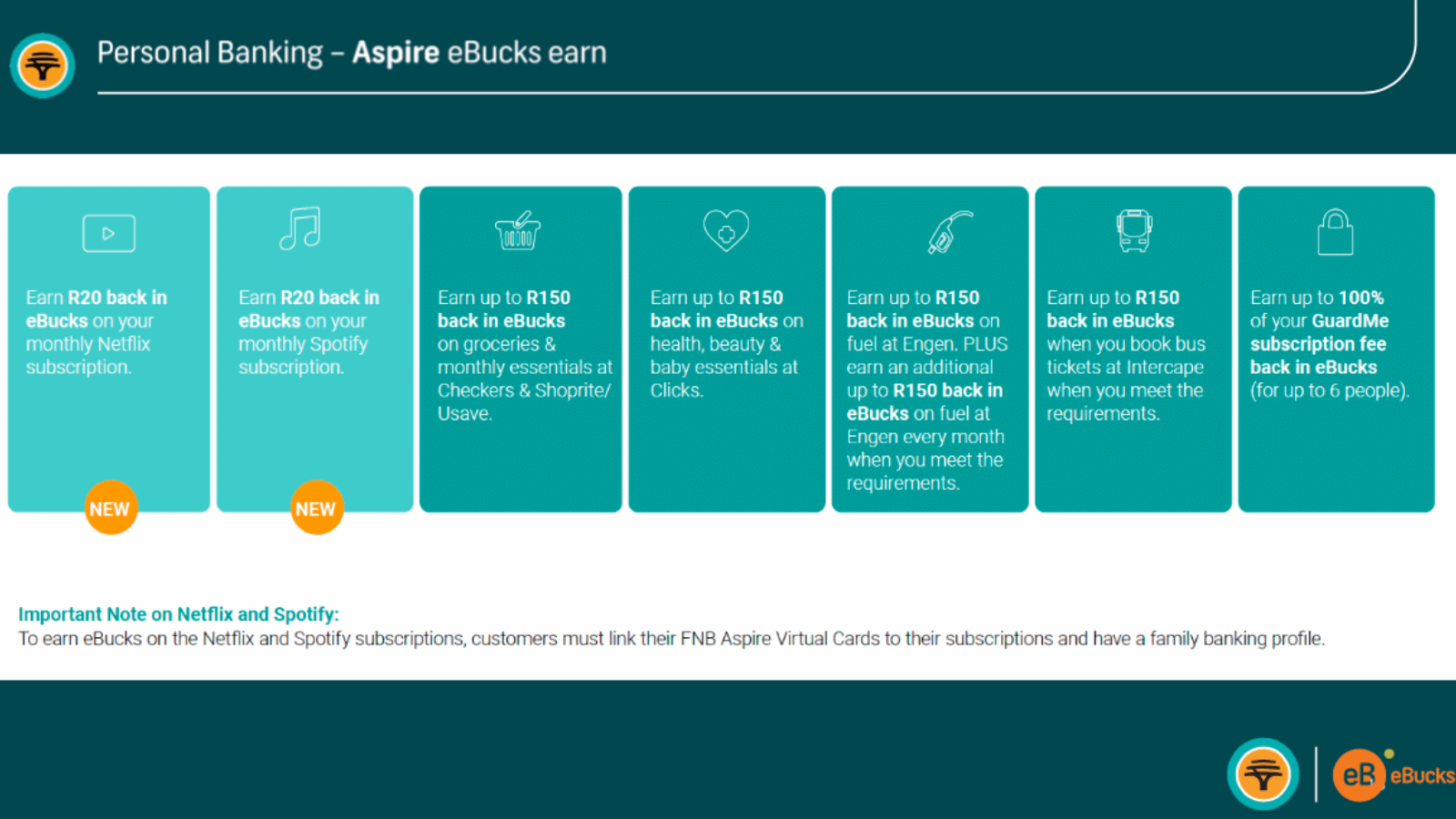

Calling all Aspire customers!

FNB’s Aspire account tier is undergoing a few changes too. To qualify for eBucks on this tier, customers must have an active account and meet the minimum monthly deposit requirements OR perform five “customer-initiated” debit transactions.

The first change for Aspire customers involves them earning R20 back in eBucks when purchasing a Netflix and/or Spotify subscription while using their FNB Virtual Cards, as long as they have a family banking profile to boot.

As for Aspire customers’ double-up fuel rewards, the new rules are similar for both the Private and Premier clients, though the Aspire customers will not have their earn rates changed, whereas the Private and Premier customers will (which can be found in this FNB eBucks Summary).

Aspire clients have access to new travel benefits, including R50 off Quickbus tickets, and R100 off domestic flights – for a combined total of R1,000 in those rewards per year.

And for those in the market for a new pair of sneakers, FNB’s Shoe Reward programme has new rules in place to earn an annual bonus of R1,000 or R1,500 towards that new pair of shoes. Previously, the programme required customers to spend R4,000/m on their Aspire debit card and increase their savings account balance by R500/m or more.

Now, customers can keep those rules in place to qualify or use FNB’s new rules for the programme which include:

- Spend at least R4,000 on the FNB Aspire Debit Card every month, plus do one of the following;

- Grow their savings account by R500 every month or,

- Maintain a savings account balance of at least R16,500 every month or,

- Have a credit status in light or dark green and engage with any NAVMoney Tool monthly or,

- Have an active FNB Connect SIM or,

- Have Cash@Till and Cardless Cash Withdrawal which are greater than your Card Present ATM Withdrawals

Should you meet those requirements for 10 or 11 months consecutively, you’ll qualify for the R1,000 shoe incentive. If you meet those requirements for a full year, the R1,500 incentive will be applied.

Easy PayU and Easy Smart account holders, listen up

FNB’s entry-level Easy PayU customers are getting some changes too. Two, specifically. We promise they’re good ones. The first concerns the monthly voucher that comes into play when purchasing essential food items from Usave, Checkers and Shoprite. It’s been increased from R15 to R20. Customers will get the voucher when spending R200 or more at these stores.

Additionally, for those clients that have an active FNB Connect SIM, the bank will begin giving out a free 100MB of data, 35 voice minutes and 20 SMSs. Not bad.

EasySmart customers will also receive two changes to their eBucks Rewards programme. First is the new discounts for Quickbus tickets, with FNB offering R50 off each one-way ticket bought through FNB’s Quickbus platform, for a total value of R500/year. Next, FNB has added more requirements for EasySmart customers to the annual R500 Checkers and Shoprite voucher, potentially allowing more people to qualify.

These are:

- Spend at least R1,000 on the FNB Easy Debit card every month, plus do one of the following;

- Grow their savings account by R100 every month or,

- Maintain a savings account balance of at least R16,500 every month or,

- Have a credit status in light or dark green and engage with any NAVMoney Tool monthly or,

- Have an active FNB Connect SIM or,

- Have Cash@Till and Cardless Cash Withdrawal which are greater than your Card Present ATM Withdrawals

Should customers fail to meet the requirements for a full 12 months, and only comply for 10 or 11 months consecutively, they will receive a lesser R300 voucher, rather than the full R500.

You can see a summary of all the changes in this FNB eBucks Summary.