It’s becoming more difficult by the day to deny that Bitcoin seems set for a meteoric climb back to all-time price highs. A perfect storm of almost universally positive investor sentiment, globally significant crypto news events and on-chain data suggesting a supply squeeze is all having exactly the effect you would expect. Bitcoin price go boom.

What’s even more exciting than a Bitcoin rally? Well, based on historical data, a Bitcoin price surge signifies the first phase in a series of investment opportunities. By following the flow of money from Bitcoin through large-cap and on to medium and small-cap altcoins, it is possible to predict where your money should be sitting in each phase for maximum returns.

In this three-part series, we’ll explain what drives this flow of money, why history is likely to repeat itself and how you can exploit your knowledge of this pattern to the furthest extent possible.

Bitcoin is Back, Baby

Before diving into exactly why Bitcoin tends to be the first mover in this strangely choreographed crypto dance, let’s get a handle on the factors driving the current Bitcoin rally.

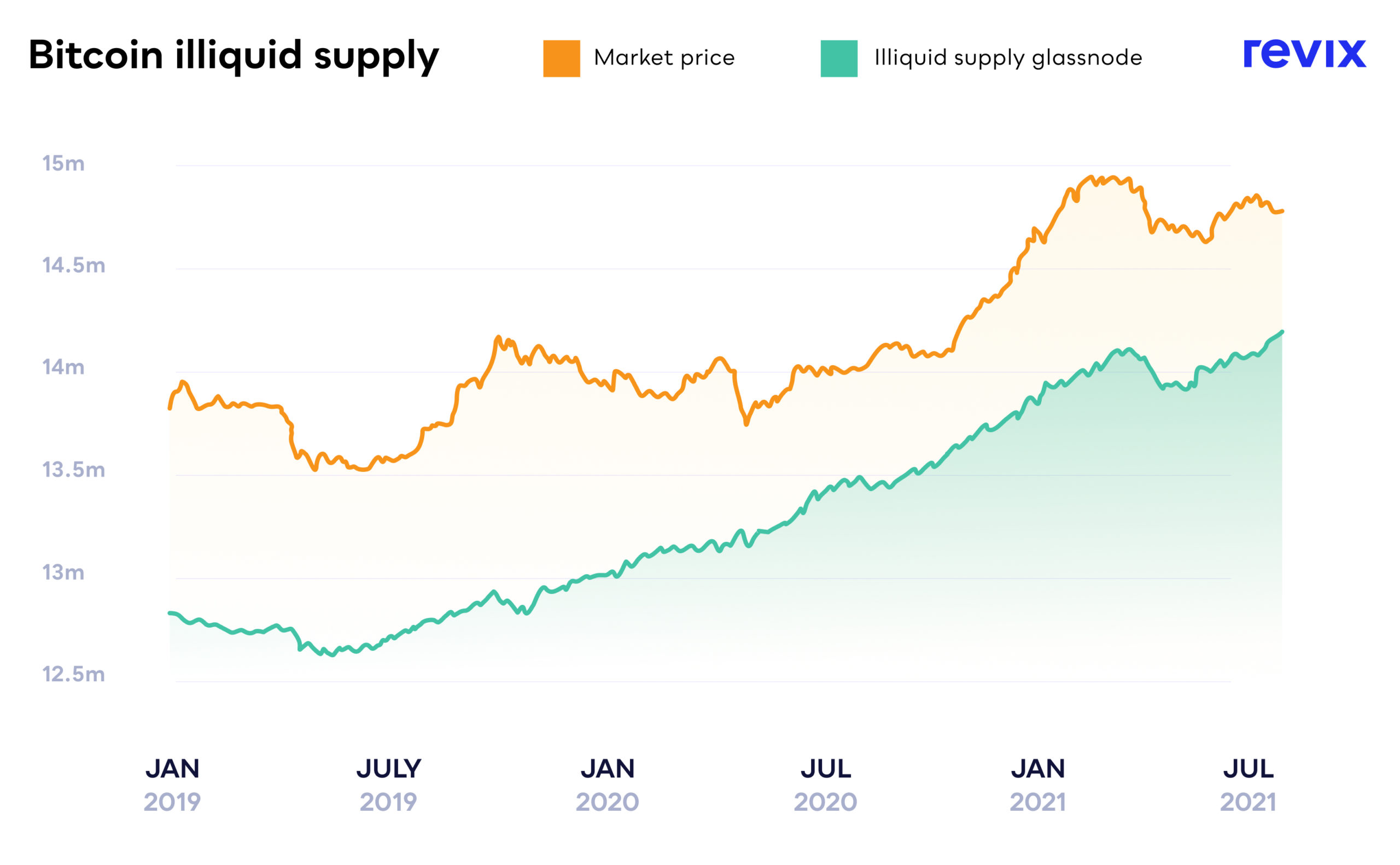

Firstly, when news of the Chinese crypto crackdown was first circulated, many traders oversold Bitcoin, lowering the price to the point where whales couldn’t help but swallow it all up. Now that those fears have largely abated, retail investors are once again bulls for Bitcoin. However, on-chain data indicates that a record amount of Bitcoin is currently not available to traders (illiquid supply), as it is still being hoarded by those same whales who aren’t ready to offer up their holdings to the market just yet. Since the dawn of trading, more buyers than sellers means prices go up, and Bitcoin is not exempt from this rule.

Renewed concerns over rampant inflation in the US is perhaps the next most significant driver behind Bitcoin’s price rally. Having already proven itself as a viable inflation hedge, the influx of investors looking to protect their portfolios from snowballing inflation is unsurprising.

Renewed concerns over rampant inflation in the US is perhaps the next most significant driver behind Bitcoin’s price rally. Having already proven itself as a viable inflation hedge, the influx of investors looking to protect their portfolios from snowballing inflation is unsurprising.

Finally, several major news events have had crypto investors losing sleep, either because of sheer excitement or nail-biting nervousness. Most significantly, a recent Bank of America report cited the crypto asset class as “too big for investors to ignore”, a significant about-turn for the traditional banking community. And, of course, everyone is keeping a keen eye on the possible approval of a Bitcoin ETF by the SEC, which will be resolved any day now.

Why Does Bitcoin Move First

With an understanding of what is driving this Bitcoin rally under our belts, let’s examine why money tends to start at Bitcoin before filtering down through the different levels of the crypto ecosystem.

The first and most significant reason is that Bitcoin remains the figurehead of crypto. When most people think crypto, they think Bitcoin. So when the media flips its collective wig when the Bitcoin price starts to climb, and crypto becomes a hot topic again, it stands to reason that people would buy the only crypto asset they know about.

In this way, Bitcoin serves as a gateway drug to the weird and wonderful world of crypto investing. With a stake in the game, new investors take more time to get up to speed with the movement, begin to gain a broader understanding of crypto assets as an asset class and invariably become excited by the potential of what is inarguably some of the most significant technologies to emerge … ever.

Finally, with a market cap well in excess of a trillion USD, Bitcoin isn’t subject to the same level of volatility as smaller-cap crypto assets. For traders, this makes it the ideal place to store profits made from trading in the crypto markets. With Bitcoin on the rise, it makes little sense to store value anywhere, so traders will snap up what Bitcoin they can while the bull run is just getting started.

Did I Miss the Party?

Did I Miss the Party?

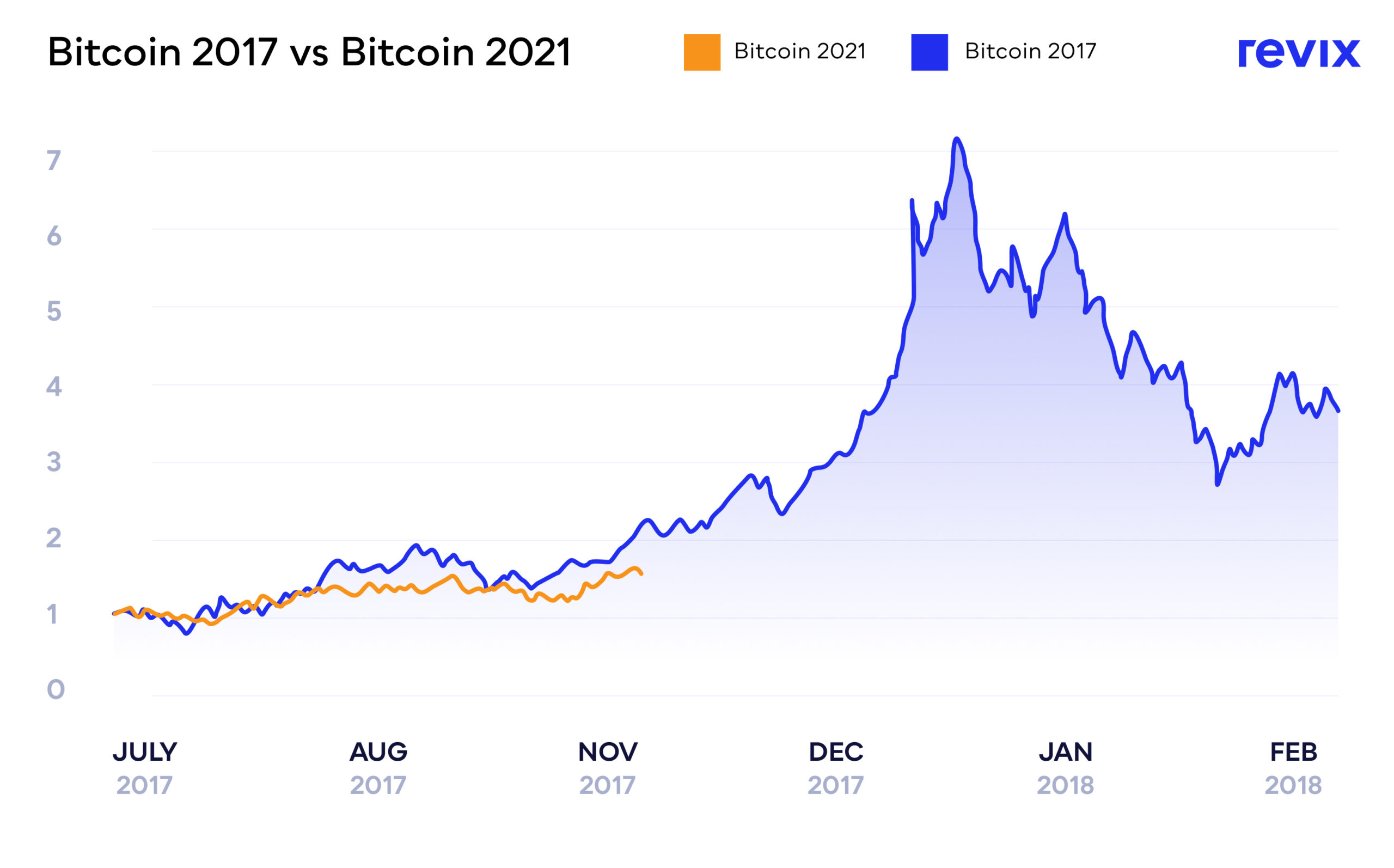

Right now, every second piece of media you see will be attempting to answer the question, “is it too late to buy Bitcoin”? So let’s summarise in as simple terms as possible. If history is anything to go by, all signs point to the fact that this cycle is just getting started. If the trend illustrated in the graph above does indeed repeat, it’s clear that Bitcoin is just getting warmed up.

To help its users get in on the action and maximise returns from this price cycle, Revix, a Cape Town-based crypto investment platform, is running a zero buying fees promotion on Bitcoin between the 15th and 21st of October. If there’s a simpler, safer way to get in on the action, we haven’t found it yet.

Where to from here?

Unfortunately, the Bitcoin price can’t climb forever. Even though this bull run will add a lengthy list of new crypto investors to the fold, all good things must come to an end. The great news is, for the informed crypto investor, the end of the Bitcoin rally is just the beginning of a series of exceptional investment opportunities. So, where should you shift your eyes when Bitcoin starts to run out of steam? Join us next week for part 2 of this series to find out.