Of all the tech-related questions that land in our inbox on a daily basis, the standout question we receive is when South Africa will be blessed with Apple Pay. Launched in 2014, the digital payment service has never been available in any African country, citing that it’s not supported on the continent at all.

But with the rise of digital wallets in the country, many banks have increased their digital accessibility through services like Garmin Pay, Fitbit Pay and Samsung Pay. Apple Pay, however, streamlines making payments in the Apple ecosystem. Many South Africans could make good use of the wallet on their Apple devices and services.

Apple Pay-ready banks

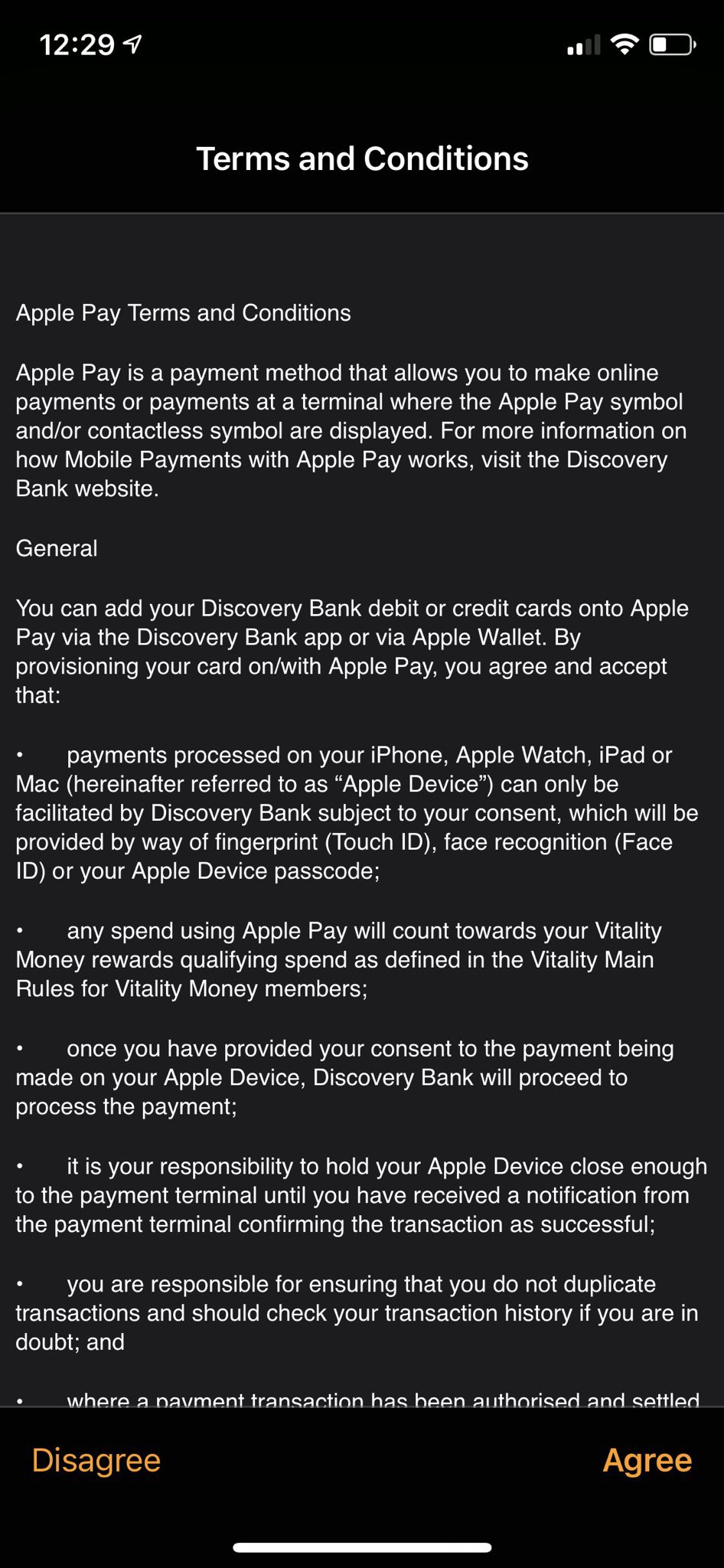

Over the past week, rumours and leaks have surfaced on the internet that may point to the official launch of Apple Pay locally. Discovery Bank and Nedbank, in particular, seem to be gearing up to roll out Apple Pay compatibility. In addition to this, Apple Pay’s terms and conditions have been updated to include Discovery Bank as a service (attached at the bottom of this article).

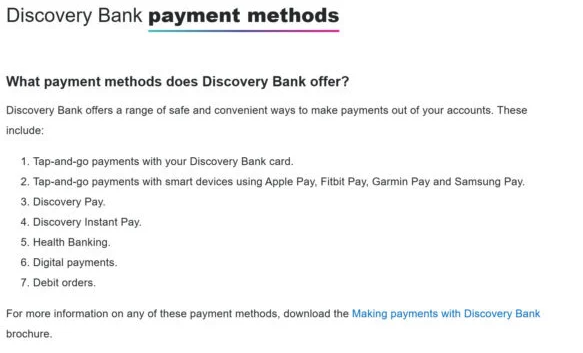

On a web page that has since been taken down, Discovery Bank’s website stated that it supports tap-and-go payments with smart devices using Apple Pay, Fitbit Pay, Garmin Pay, and Samsung Pay. In addition to this, a Twitter user sent Discovery Bank a message asking when it’ll support Apple Pay. The bank’s response was that it already supports Apple Pay, apparently. Clients of the bank tried to load their cards on Apple Pay, but received error messages — so it’s not supported as of yet.

Another Twitter user and tech journalist Nafisa Akabor picked up that Absa Bank had uploaded ‘how-to’ videos to YouTube that details methods to connect your bank card to Apple Pay. The videos were made private immediately after, but this suggests that banks are gearing up to roll out the feature soon.

We contacted Apple South Africa for more clarification, but they declined to comment at this time. No information about other local banks like FNB or Standard Bank supporting the service has been made available.

Apple Pay Ts & Cs