South Africa has been going through a type of banking revolution in recent years. We saw the establishment of a few key new digital banks that were geared to take on the traditional brick-and-mortar banks. Now it looks like Bank Zero is set to take on all of the above with its zero-fee banking options.

It’s been a while since we last heard from ex-FNB CEO Micheal Jordaan’s new venture. Bank Zero is now reportedly up and running for a small group of customers in a closed beta. It will launch officially in 2021, so it’s clear they’re running a few semi-public tests to see how the formula works.

How it works

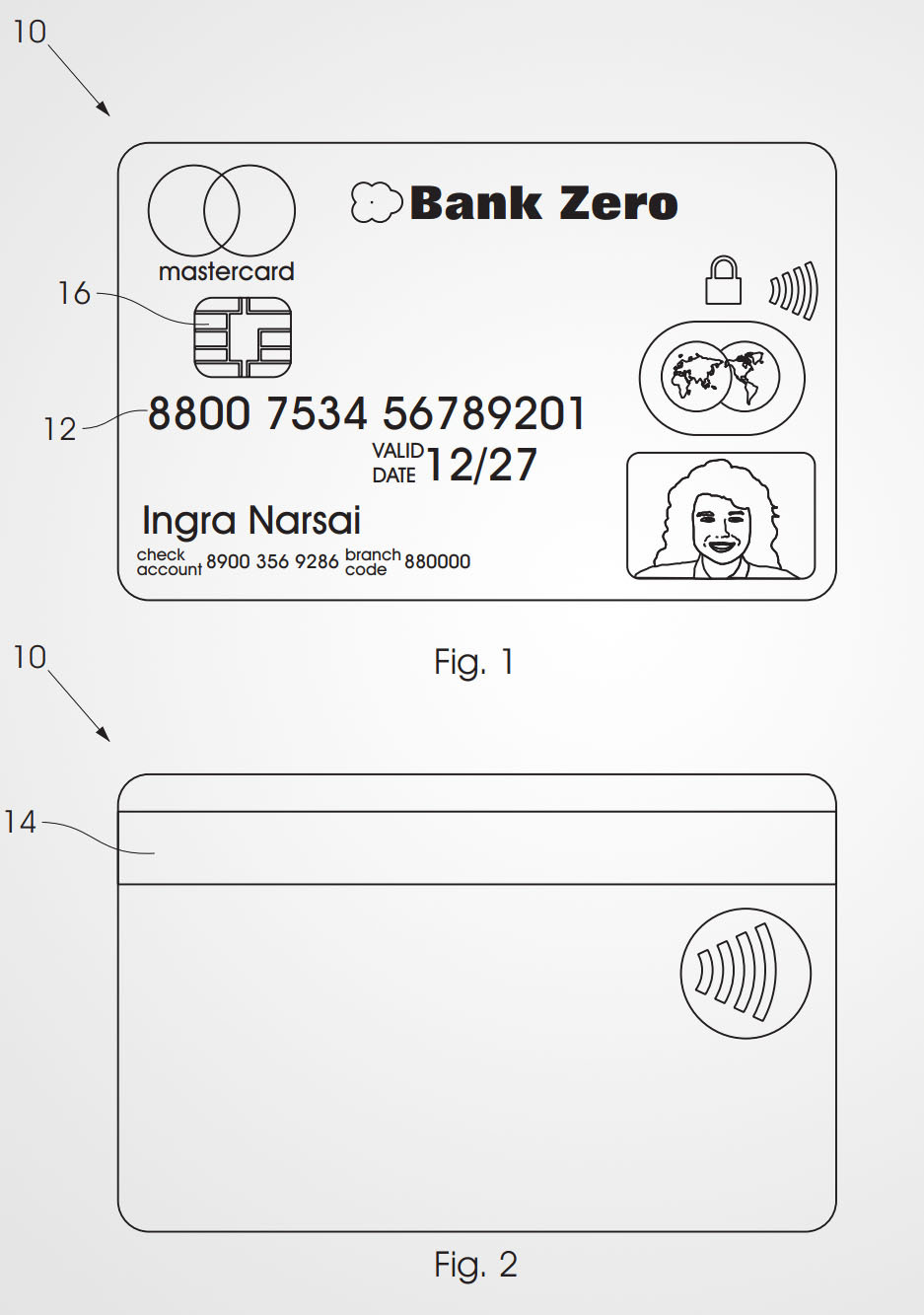

As the name suggests, Bank Zero won’t charge monthly banking account fees. It sounds relatively similar to opposing digital bank Tymebank, but according to Bank Zero CEO Yatin Narsai Bank Zero features a patented bank card that’ll set them apart from other digital banking offerings.

It’ll be structured as a mutual bank, while there won’t be any physical branches. If you’re not convinced, think back to those terrible queues just to make payments, activate banking apps or find out about a loan. Maybe no branches isn’t a bad thing?

It’ll be structured as a mutual bank, while there won’t be any physical branches. If you’re not convinced, think back to those terrible queues just to make payments, activate banking apps or find out about a loan. Maybe no branches isn’t a bad thing?

On to the special card: Bank Zero’s patented bank card features three unique identifiers or ‘numbers’. First, you have the physical card number that’s embossed on the face, then there’s the number allocated to the mag strip and third, there’s the microchip. In this card, each of those numbers differ for each issued Bank Zero card.

The embossed number, visible to everyone, will be used for any situation where 2-factor authentication can be used for online payments, for example. This is the only situation where this number will be used. Secondly, the mag strip number will be used for swiping at point-of-sale devices. And lastly, the ship-number will be used for a tap-and-PIN situation.

Bank Zero on security

All of this confusion and number-hoarding is done for a good cause, believe us. You know those card-skimming devices placed on ATMs? They generally only skim the number off your card’s mag strip. If they were to do this with a Bank Zero card, they won’t have direct access to use the card for online payments. Even if they get the PIN.

Another nifty feature, is that users won’t be issued new card numbers if they were to request a new card. This removes the need to update your banking details/card info for online payments, which is a nice touch.

Although it’s not officially available to the wider public, we’re keen to see how the new service runs in the beta test. It’s an interesting bid to focus on a more secure bank card, but we’d like to see what services Bank Zero offers upon launch.