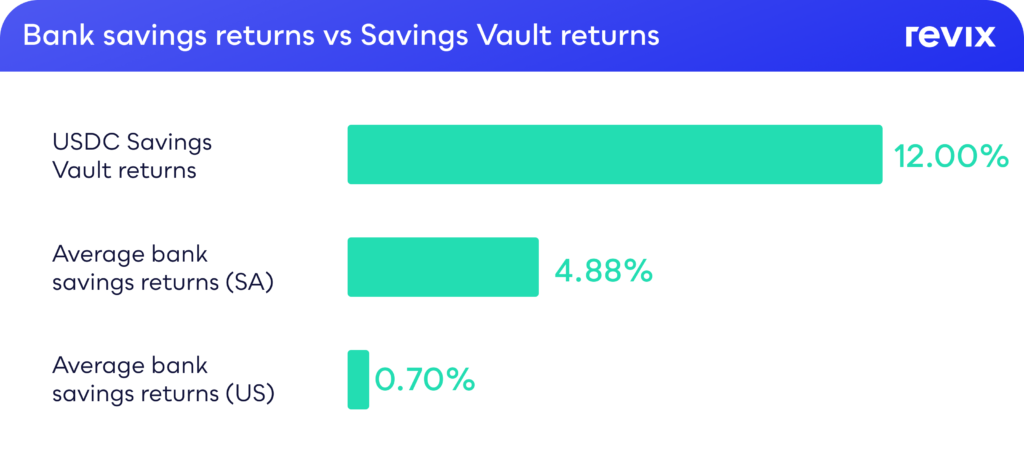

A savings account remains the go-to investment for most people who want to preserve their wealth in the medium to long term. The reasoning seems sound at face value. Your savings are secure and, based on analyses of the best South African savings accounts, you can expect to earn an average 4.88% return.

Looking just beyond the banks’ sales pitches though, reveals that the picture isn’t so rosy.

Inflation is currently at 5.9%. If you’re investing in an account that isn’t beating inflation, then you’re losing money.

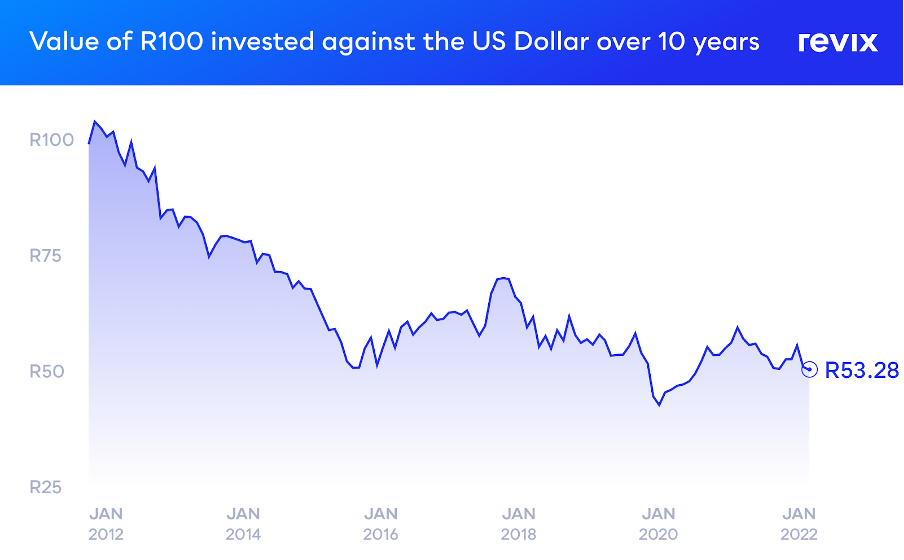

That’s not even taking into consideration that over the past 10 years, the South African Rand has depreciated at roughly 4.3% a year against the US Dollar. The direct result is that the average South African’s wealth, measured by international standards, has depreciated by 4.3% every year for the past 10 years.

In practical terms, if you’ve held your savings in a South African savings account for 10 years, it has lost around 46% of its international purchasing power. Considering that we haven’t even factored inflation in this calculation yet, it becomes starkly evident that the long-trusted savings account may no longer be a viable way to preserve wealth.

So beyond navigating the complications and legalities of an offshore savings account, what is the ordinary investor to do? Revix, a Cape Town based crypto investment company, has combined the power of crypto and DeFi (Decentralised Finance) to bring a solution to South Africans.

The Revix Savings Vault makes it possible to save in a US Dollar-denominated account, without having to jump through any hoops, while delivering a 12% return. How is this possible? Let’s take a look.

DeFi has rewritten the rules of the savings account

To most people, the word cryptocurrency still just means Bitcoin, but the crypto landscape has expanded exponentially to become about much more than just Bitcoin. Decentralised Finance, or DeFi, is an entire ecosystem of financial services that operates without any central authority and is available to everyone. DeFi may indeed become the next phase in the evolution of the global banking and financial system, but it is already changing the way that investors think about one of the oldest and most trusted investments, the humble savings account.

To understand how DeFi has turned the concept of the savings account on its head, you need only look at the numbers. Let’s imagine a bank offers its customer a +1% return on their savings. Behind the scenes, that bank then lends that money to another customer at +5% interest and pockets the +4% profit.

What if it was possible for that customer to securely lend their savings directly to others, earning the full +5% return in the process? Facilitating exactly this kind of direct transaction between people while eliminating intermediaries is what DeFi is making possible.

By making use of applications built on DeFi protocols (dapps), you can lock your crypto into the vault and earn an APY for the duration of the lockup period. Unlike a traditional savings account, savings vaults use these protocols to provide you with the full return that you deserve.

This new generation of savings accounts has largely been enabled by a specific type of cryptocurrency, called a stablecoin. Understanding stablecoins is key to understanding savings vaults.

What is a stablecoin

Stablecoins are different from traditional cryptocurrencies because they’re backed by an asset, such as the U.S. dollar or gold. In other words, they’re simply tokenised versions of the U.S. dollar, gold, or other reserve assets. This helps keep their prices stable, so they’re not subject to the same level of volatility as other cryptocurrencies.

Stablecoins are designed to be a middle ground between traditional cryptocurrencies and fiat currencies like the U.S. dollar. While they’re still a type of cryptocurrency and can be used as a form of payment, they don’t experience the rollercoaster of ups and downs.

Stablecoins and savings vaults are therefore a viable solution to wealth erosion as a result of a depreciating local currency. A USDC-based savings vault makes it possible to effectively convert your savings to US Dollars while earning a 12% return on your stablecoins.

In this way, you’re avoiding the depreciation that you would suffer as a result of holding rands (+4.3% gain) while also earning an additional 12% on these assets. Assuming you got 12% on the balance of your Savings Vault, this two-fold gain would translate into a +16.3% net return on your South African rands. Compare this to the actual return on your average traditional savings account, and the difference is astounding.

How to start saving and earning in 12% in USDC

Cape Town-based Crypto Investment platform Revix, saw the value of bringing a USDC Savings Vault to South African investors early on. For over a year, Revix’s flexible US Dollar-denominated savings account has offered an interest rate well above market.

Now, the long-trusted Revix USDC Savings Vault has been upgraded to offer investors an even higher annual return. This enables you to effortlessly earn interest using your USDC holdings just like a high yield US dollar savings account. The only difference being that you’ll earn a far higher return than any dollar savings account can offer.

Starting 6 May, Revix’s Savings Vault will provide you with a 12% APY on your USDC. A minimum investment of 100 USDC is required to qualify, and there is a minimum lockup period of 30 days in order not to attract fees. T&Cs apply.