Wartime investing: Why gold is outperforming Bitcoin and stocks

Vladimir Putin’s decision for Russia to invade Ukraine sent shockwaves through investment markets. Stocks, oil, crypto, and every other investment category are seeing sharp changes in price — something that is known as price volatility.

Armed conflict, sanctions imposed on Russia and the rising possibility of nuclear fallout, all create uncertainty in the markets. Many fund managers and investors are moving their funds from what is perceived as risky investments to more reliable ones.

Many investors are now quickly turning to safe-haven investment options — investments that do well when there is increased fear in the market — like the US dollar and gold.

Something similar played out in the first few months of the COVID pandemic in 2020, with gold and the US dollar skyrocketing to their highest prices on record.

What are safe-havens?

Safe havens are investments that maintain or increase in real value or outperform financial markets in times of market uncertainty. Investors seek out these safe-haven investments to maintain and, in some cases increase, the value of their investment portfolios in market downturns.

The current state of the world (Russia invading Ukraine, the world experiencing higher inflation, and global supply chain stress) points to the opportunity for safe-haven investments to help preserve your hard-earned wealth.

When it comes to safe-haven investment options, there are some strong contenders. The US dollar performs well as it is a reserve trading currency, but no other safe-haven has the tried and tested performance to that of gold. To this day, gold has held the throne and proven itself as the world’s number one safe-haven asset.

For those sadly lacking a gold bullion vault or access to US dollars, Revix, the FinTech backed by JSE-listed Sabvest, offers a simple and cost-effective way to invest in both with as little as R500.

How to invest in USD and gold with Revix?

You can easily and securely get US dollar exposure through USD Coin (USDC) — a stablecoin and type of cryptocurrency pegged to the US dollar on a 1:1 basis. You can always redeem 1 USD Coin for US$1.00, giving it a stable price.

You can effortlessly invest in gold through Paxos Gold (PAXG), a US regulated and insured ounce of gold that sits on a blockchain. PAX Gold is for anyone looking to invest directly in gold without the custody and insurance burdens of physical ownership. One PAXG token is backed by one fine troy ounce of the highest quality gold stored in high-security, fully insured vaults.

With all Revix’s investments — including USDC and PAXG — there are no lockup periods. You can withdraw your funds at any time. Revix’s live customer support team can guide you through the sign-up process to your first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

How has PAX Gold performed in times of uncertainty?

With the markets being threatened, how is PAX Gold performing in these unpredictable conditions?

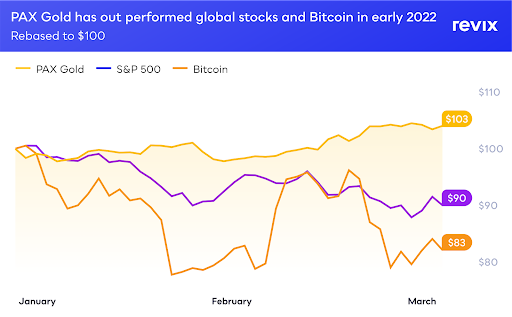

The below chart compares the performance of PAX Gold, Bitcoin and the S&P 500 since inflation worries and wartime uncertainty have affected the market.

PAX Gold has stayed true to its assurance as a safe-haven asset and is currently outperforming Bitcoin and the S&P 500. If you had invested PAX Gold at the beginning of this year, you would be up +3.88% as opposed to losing -9.53% or -17.05% had you invested in the S&P 500 or Bitcoin, respectively.

When it comes to gold, investors should consider it an essential part of a diversified investment portfolio. It is an effective way to offset losses from more volatile assets during uncertain market conditions. When the value of paper investments (such as stocks and bonds) begins to decline, gold’s price often rises.

Where can I invest in USDC and PAX Gold?

South African FinTech Revix introduced USDC and PAX Gold as investment options back in 2020.

Investment Promotion

Cape Town-based crypto investment platform Revix (www.revix.com) will be the first platform in South Africa to offer Terra (LUNA) — 2021’s top-performing coin with returns of over 14,700%.

Revix is offering 0% buy-in fees on Terra (LUNA) for one week, starting on the 25th of February and ending on the 3rd of March 2022.

What else does Revix offer?

Revix also offers three crypto Bundles that are like the S&P 500 for crypto. Investors gain diversified exposure to the top-performing crypto assets in just a few clicks.

The Top 10 Bundle provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies, including Bitcoin, XRP and Litecoin. These cryptos aim to make payments cheaper, faster and more global and are aimed at those who believe making payments with cryptos will become as easy as sending an email.

The Smart Contract Bundle provides equally weighted exposure to the top five cryptocurrencies built around smart contracts and includes the likes of ether, EOS and Tron. Smart contract cryptocurrencies sit on the blockchain rather like mobile apps rest on Android or iOS. These cryptocurrencies aim to revolutionise how supply chains and trading networks operate through smart contracts. This is Revix’s top-performing Bundle as it has benefited from the explosive growth in the decentralised finance (or DeFi) space in 2021.

About Revix

Revix brings simplicity, trust and great customer service to investing. Their easy to use online platform enables anyone to securely own the world’s top investments in just a few clicks.

For more information, please visit www.revix.com

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.