As we move into the new year, you may be wondering how the crypto market will develop in the coming years. Is it “too late” to be investing in this new world? If not, then how do you go about picking a winner?

Before deciding if it is too late, let’s take a look at a quick recap of 2021.

2021 was the year of institutional interest and global adoption.

As clear as a bell to those who pay attention – the tides of institutional adoption started to shift in 2021. What was once a “don’t touch” sector for the institutional market has quickly become an evolving avenue for high-growth investment allocations in venture capital funds, as well as balance sheet protection against holding fiat in a negative interest rate environment.

Fresh off the cross through $20 000 in December 2020, Elon Musk announced the addition of $1.5 billion in Bitcoin to Tesla’s balance sheet. This news was enough to see Bitcoin’s market capitalisation surpass $1 trillion for the first time on February 19th.

With this trillion-dollar tag came interest from some of the world’s largest institutions. Prestigious investment houses and banks, such as Blackrock, Morgan Stanley Investment Management and more than a dozen others have started to show interest in the world of crypto. Venture capital firms were also eager to get involved, allocating over $30 billion to crypto-related startups over the course of the year.

Finally, to top off 2021, we saw the US regulators grant approval to one of several futures-backed Bitcoin ETFs. Thus allowing institutions an easy way to gain exposure to this asset class under a regulatory framework.

Is crypto a big opportunity or am I too late to the party?

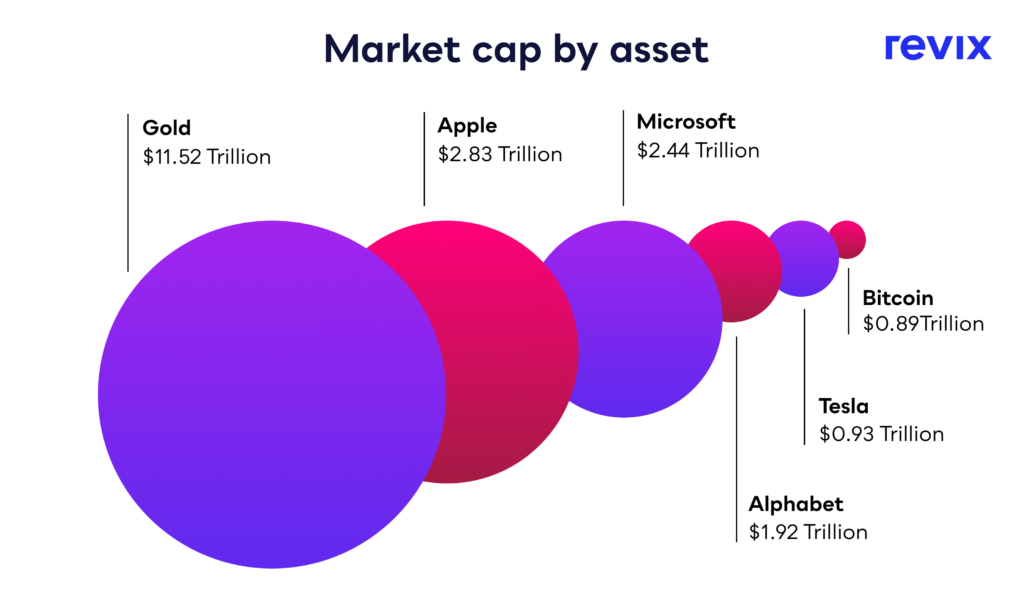

While crypto’s dramatic rise may lead many to believe that they are “too late” to invest in the crypto market, zooming out and comparing crypto in its current state to the world’s most valuable assets, provides a different perspective.

As we can see above, Bitcoin is still a drop in the ocean when compared to multiple companies or asset classes.

Most compare Bitcoin to Gold, citing the multiple comparisons that can be drawn between the two. If this is the case, Bitcoin still needs to make a 13x move to surpass the precious metal.

That means if you invest R10 000 today, it would be worth over R130 000 if it were to overtake Gold by market cap.

Let’s take it a step further. The entire crypto market is currently valued at over $2.2 trillion. Now that’s a big number right? Well, in context, it’s actually not. Numbers like this often fly straight over our heads without any grounding or perspective – so let’s provide some.

The global stock market has a total value of around $121 trillion, while the global derivatives market has a value of around $1.2 quadrillion. Comparing those numbers to crypto’s relatively tiny total value of $2.2 trillion makes it clear that crypto represents a tiny part of the global asset base and that there is still massive room for growth.

How do I pick a winner?

At a glance, the cryptocurrency market can be an overwhelming place, especially for those not well-versed in it.

Much like the internet boom of the early 2000s, thousands of blockchain-based projects are being developed, and loads of confusing jargon and technical slang are being shared far and wide.

This makes it near impossible to pick the next Amazon or Google of the cryptocurrency world and tougher yet to hold onto them for a sustained period of time.

One way to lower your risk investing in the cryptocurrency space is to own a diversified basket of the top 10 cryptocurrencies that gets automatically updated every month. Currently, the top 10 cryptocurrencies (excluding stablecoins) account for 75% of the total cryptocurrency market capitalisation, so you’ll gain exposure to the broader growth in the crypto market and not be heavily dragged down by any individual cryptocurrencies.

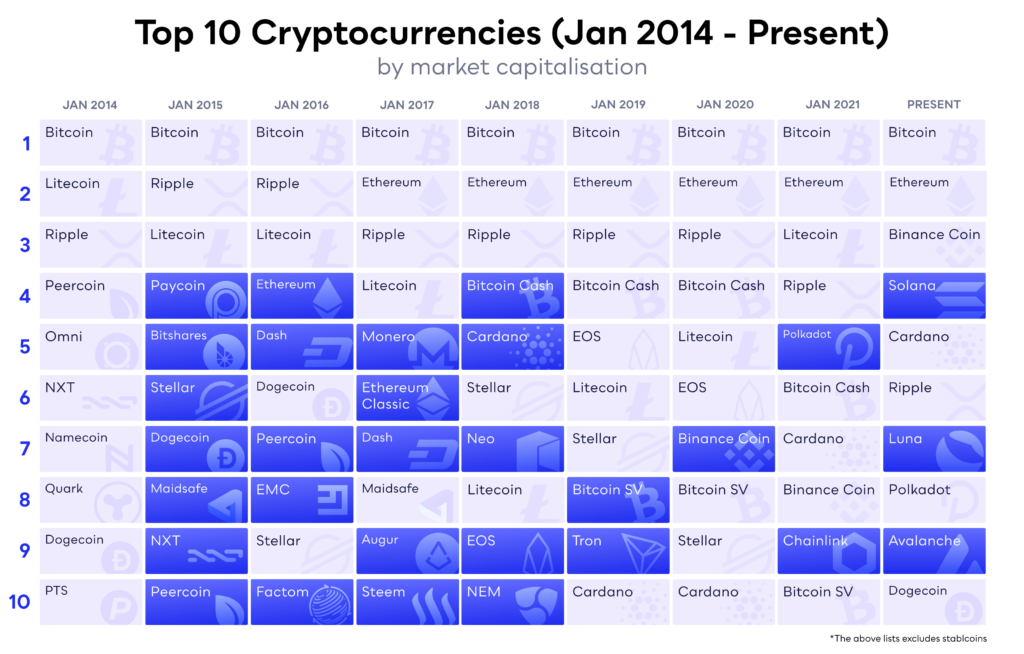

Another factor to consider is how much the top 10 has changed over time.

Over the past 8 years, only 3 cryptocurrencies have managed to stay in the top 10: Bitcoin, Ethereum, and Ripple, and only 1 was able to significantly grow its market share (Ethereum from 11.31% to 20.50%).

A prudent investor should seek an investment product that helps capture these changes and thus keeps the investor well-diversified across the crypto universe at all times.

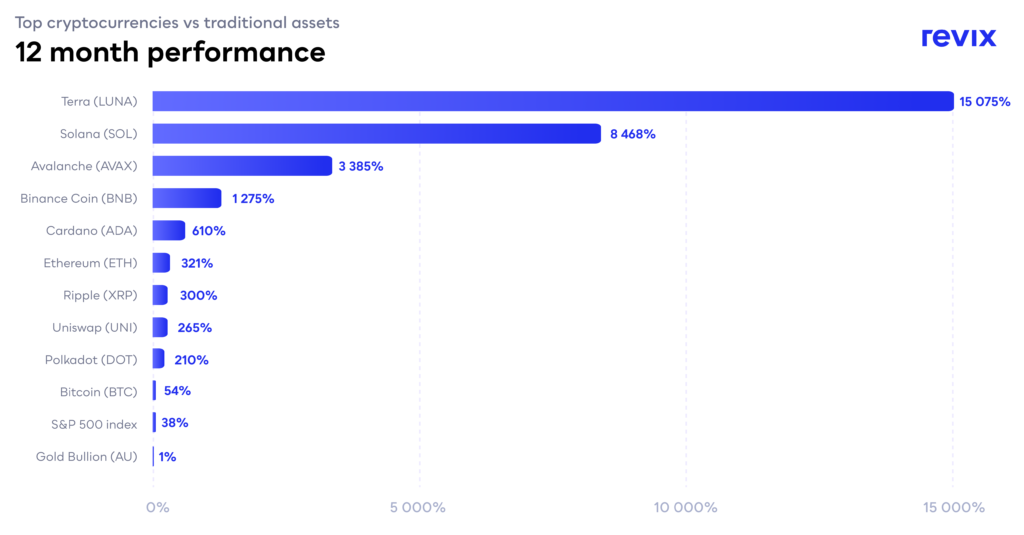

Now, we know many will say that if you only held Solana or Luna you would’ve outperformed everyone, but the truth is hindsight is 20/20.

What is meant by this is that these picks, like Solana, are easy to spot a year down the line when they have already done well, but are near impossible to select in their infancy unless you are a seasoned investor or just get lucky. Not only that but you would have to hold onto it for a sustained period of time.

There is also a caveat to this, the volatility you receive and the risk you take on by holding one asset becomes almost impossible to stomach.

Above we can see the returns of the current top 10 cryptocurrencies against some traditional assets. One thing becomes very clear – all the top cryptocurrencies have outperformed traditional assets over the last 12 months.

But keep in mind, while we might have been able to assert an educated guess that crypto would’ve outperformed traditional assets in 2021, we did not know which cryptocurrencies would do the best over the year – would it be Luna, Solana or even Bitcoin.

So it raises the question: why not just gain exposure to all of them?

Holding a diversified bundle on the top 10 cryptocurrencies not only outperforms traditional assets, but it also outperforms many of its standalone components. Not only that, but you get to enjoy a smoother ride as diversification reduces volatility.

The Solution: The Revix Top10 Bundle

Building a diversified crypto portfolio requires investors to do their own comprehensive research, decide which cryptos are best to hold for exposure to certain market sectors, and constantly reweight their portfolio to keep in line with the fast-paced nature of the crypto market. This is clearly neither a simple, nor a time-efficient task.

Revix, a crypto investment platform based in Cape Town, was founded to solve that very problem. In addition to making it easy and safe to buy individual cryptos, Revix’s claim to fame is its crypto Bundle offerings.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 75% of the crypto market. This bundle includes all the cryptocurrencies mentioned in this article and has significantly outperformed Bitcoin over the last 12 months.