In the face of last week’s BTC price plummet and the crypto market painting itself in Christmas red as the year draws to a close, you can’t be blamed for following the media hype to the conclusion that crypto may be leaving empty boxes under the tree for investors in 2021. So is it time to reevaluate storing cash under your mattress, or is the market giving retail investors the ultimate festive season gift, discounted crypto? Let’s discuss.

What’s with the dip?

Right off the bat, let’s look at some data that can help us decide if what we’re seeing in the crypto market signals the much-heralded end of crypto or if it is, in fact, simply the result of observable and even predictable phenomena driving prices down.

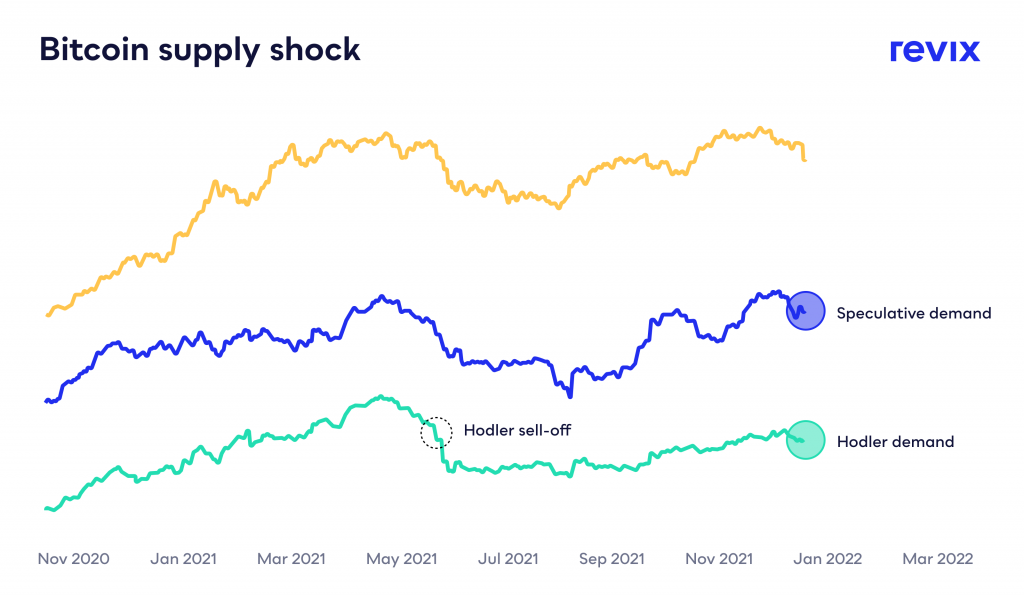

The graph above tracks a metric called supply shock for Bitcoin from November 2020 to present day. Supply shock is measured as a ratio of investors that have a history of not selling vs those who are more likely to sell. It is based on past behaviour, as indicated by wallet histories.

Supply shock allows us to evaluate the investor sentiment of those more likely to hold BTC in the long term vs those who are likely using BTC in trades or speculating on its price. Given that we saw a nearly 23% drop in BTC’s price in a single day just a week ago, it’s interesting to see, as per the graph, how stable and positive long-term Bitcoin investor sentiment has remained. If HODLers aren’t showing any bearish signs whatsoever, what caused the dip?

The most likely explanation is an event called a market flush, a sudden sell-off of over-leveraged long positions as a result of investors becoming a lot more risk-averse in a short period of time. Don’t worry if that sentence seems to be written in another language. What you need to know is that a flush is a very common occurrence that is in no way exclusive to the crypto market. It happens in almost every market, from commodities to equities.

In addition to the flush, traditional markets have slid in response to yet another high inflation print from the US Federal Reserve and what that might mean for future interest rate hikes, as well as fear around what the Omicron variant is going to mean for global markets.

So now that we know the dip wasn’t caused by investors deciding that there is no future for crypto, but also that volatility will always be something that investors have to contend with, how can we take advantage of this price dip and build an investment strategy that reduces the impact of volatility on our wealth?

Dollar-cost averaging as the path of least resistance

Sure, you could take this opportunity to buy crypto at a discount, but who’s to say that prices won’t drop further. Even when they do go back up, how do we know they won’t just return to where they are today?

The truth is, not even the most sophisticated trader has a crystal ball that can predict exactly what will happen. The point is, for the long-term investor, short-term volatility is largely irrelevant.

Dollar-cost averaging (DCA) is a strategy in which, rather than investing a lump sum, an investor divides up the total amount and invests those sums periodically, regardless of market conditions. Because these smaller investments are made over a longer period of time, during which market volatility will be moving the price of the asset both up and down, DCA can substantially reduce the volatility that a single investment would otherwise be exposed to.

DCA is a favourite strategy of long-term investors. It doesn’t require timing the market in order to choose the perfect buy-in price and making fixed periodical investments regardless of market conditions, but it eliminates the need to constantly check prices and evaluate market conditions.

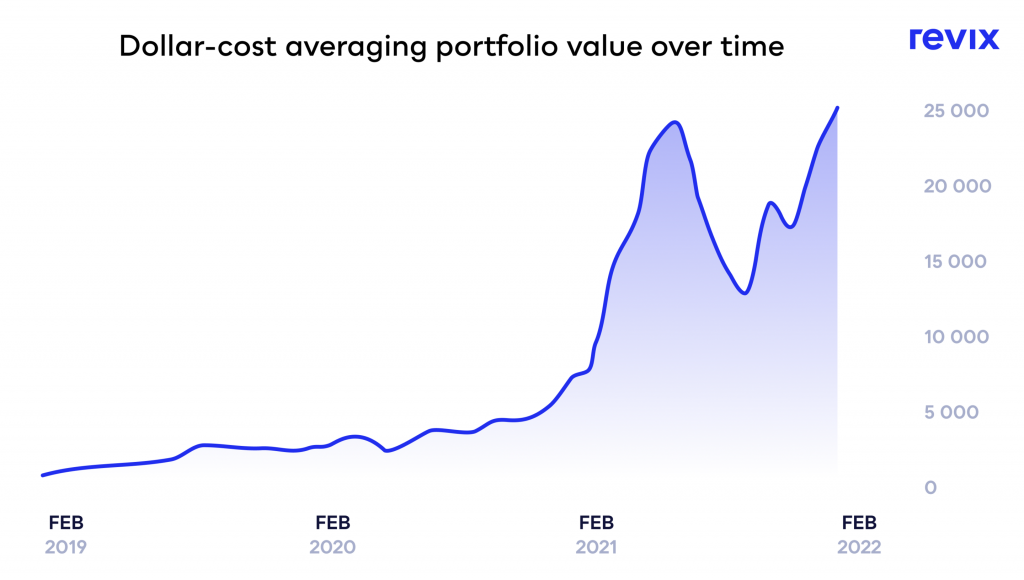

The graph above shows the value of a portfolio following a DCA strategy over the last 3 years. You can see that, while an investor who bought in at the first peak in 2021 may have had a tough time holding through the dip that follows if they simply continue with DCA and hold, none of that price volatility actually affects the net value of their portfolio in the end.

Isn’t the big money in trading?

While it can’t be argued that traders aren’t able to compete with the returns that long-term investors are realising in the crypto space, it must be noted that a tiny minority of traders are able to turn a profit. What’s more, keeping up with the blistering pace of the crypto market requires a massive time commitment.

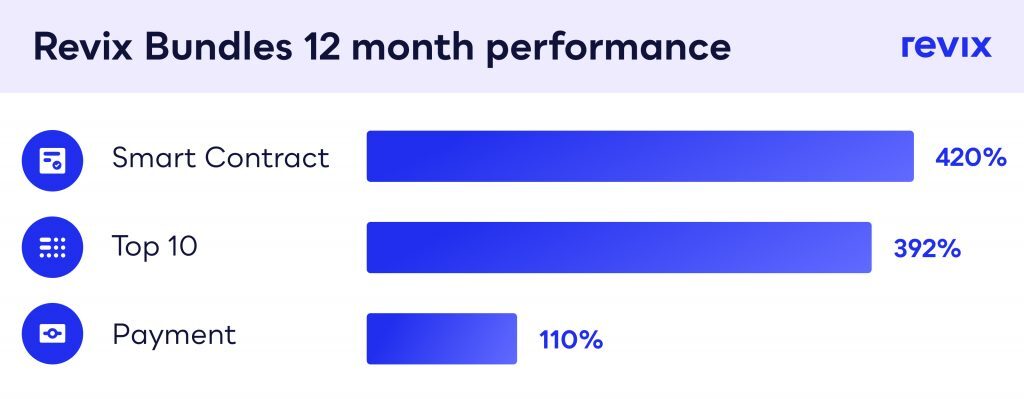

Is it really worth being a HODLer, though? We’ll let the graph below speak for itself.

This festive season, make smart investments a new family tradition!

With all the most promising cryptos on the market currently available at a steal, and the knowledge that you don’t need to be a professional trader to see absurdly impressive returns on a crypto investment, this festive season is feeling like an ideal opportunity to make the habit of investing a part of your life, and the lives of your family and friends.

“I think the simple act of saving can make a life-changing difference to peoples financial wellbeing. Instead of giving another candle or beach towel this Christmas, maybe people should think about giving an asset or an investment to their friends and family. Giving an investment means giving something that will appreciate in value over time and possibly help those who receive it tenfold in the future … much more than that beach towel ever will,” say Brett Hope Robertson, Head of Investment Analysis at investment platform Revix. You don’t need another reason to make December 2021 the month that you and your loved ones start your investment journey together, but Revix, a crypto trading platform based in Cape Town is giving you one.

Between the 17th and the 29th of December 2021, whenever you refer someone to Revix using your unique referral code, they’ll receive R500 when they sign up for and verify their account. What’s more, you’ll earn Revix Rewards Points, which can be redeemed for Bitcoin.

It’s your chance to help your loved ones to discover a safe and simple way to invest in crypto.