While the US just posted the biggest inflation number in 30 years – many have asked what this means for them.

Most people think inflation is just a word used by portfolio managers, while others simply know it’s why they’re paying more for a loaf of bread from one week to the next, but what you don’t know is what inflation truly means for you, yes you.

People don’t realise the far-reaching effects inflation can have on your financial situation and how hard it can make it for you to grow your wealth.

Inflation is described as the rate at which the price of a basket of goods and services increases over time. For most people, the direct personal cost that inflation exacts on their lives flies under the radar. It is accepted as an inevitable part of modern living. It’s something that can’t be solved and is therefore not worth worrying about. The numbers tell a different story.

It’s worse than you think

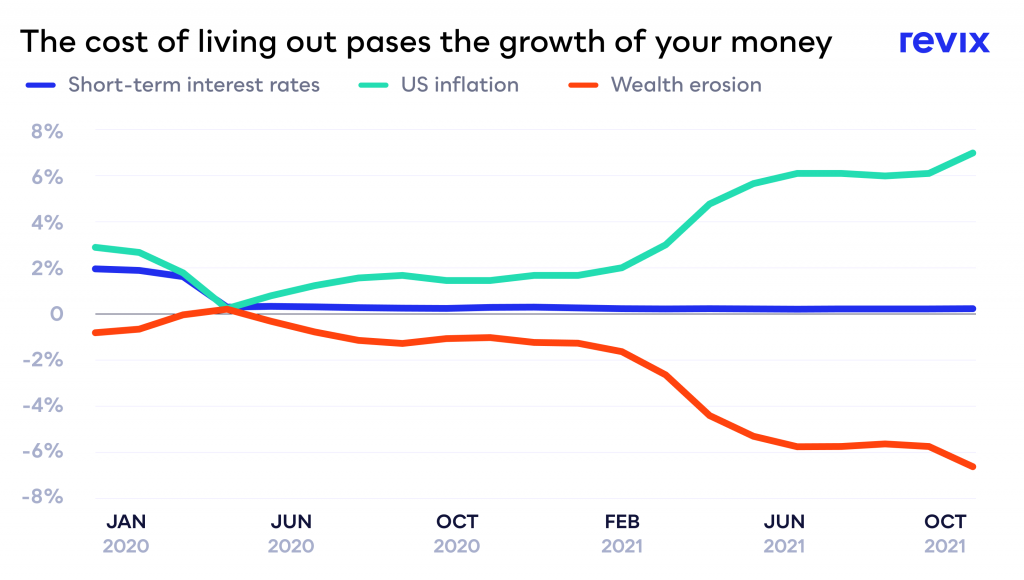

The US just printed its highest inflation rate in over 30 years, 6.2%. In other words, the average cost of living in the US has become 6.2% higher over the course of just a year. But a 6.2% increase isn’t such a big deal right?

Well, when you consider that this is over 20x greater than the return that you can expect from the average savings account in the US (0.3%), your perspective might start to shift.

That’s right. Interest earned on money in a savings account (0.3%) will barely cover 1/20th of the increased cost of living (6.2%) that the average American is experiencing. Put another way, your money allows you to buy around 5.9% less than it did a year ago.

“Now I know 5.9% doesn’t sound like a lot, but if that rate continues for 10 years, people would have lost roughly 75% of their buying power. Looking at that number, it’s easy to see why it is becoming more and more difficult for people to achieve any level of financial stability.” Says Brett Hope Robertson, Lead Investment analyst at crypto Investment platform, Revix.

Unfortunately, that isn’t the full extent of inflation’s impact. The inflation rate you see in the media is calculated based on the cost of living. For people trying to create wealth through asset ownership, that number is far higher.

For example, around 36% of all US dollars in existence were printed between January 2020 and now. In other words, if your money wasn’t in an investment that yielded at least 19% growth per year, your wealth in terms of what you could afford in January vs today is diminished.

Asset inflation

Realising the full impact of inflation on personal wealth has driven many people across the world to convert cash to assets that protect their wealth against inflation. While this is a smart move, it tends to trigger a different kind of inflation called asset inflation.

Asset inflation refers to how much the price of an asset goes up in a year.

Towards the end of March 2020, when the US first hinted at its now-notorious money printing habit, a single share in Apple Inc would set you back just $58. That same share today will cost you $150. A prime example of asset inflation in action.

The cost of Apple shares is an extreme example, but it makes the point clear.

These numbers affect everyone.

Whether you are looking to buy a house, eat healthily or simply trying to fill up your car, life is becoming expensive, and your money just isn’t keeping up.

“My cash is losing value every second…How do I protect myself?”

Throughout history, investors have looked to protect their wealth in times of inflation by buying assets that will either keep up with inflation or beat it. Gold, shares and housing have traditionally been the best options, depending on the level of inflation. These assets are known to the finance world as ‘inflation hedges’.

Inflation hedges – We know that inflation increases the value of things you want to buy tomorrow. Therefore, tomorrow you will need more cash to buy these items than you did today. To solve this issue, you should simply use your cash today to buy an asset that will increase in value at the same rate or more than inflation is increasing other assets. In this way, your wealth is protected, or ‘hedged’.

Are cryptocurrencies a new option for wealth protection?

Blockchain technology has heralded the rise of an entirely new asset class.

The poster child for cryptoassets as a hedge against inflation is undoubtedly “digital gold”, otherwise known as Bitcoin. The original cryptocurrency shares many of the same properties as gold in terms of its suitability as a store of wealth and a protector against inflation.

Unlike the US Dollar, which saw its supply increase by more than 36% since Covid, Bitcoin has a programmed release of coins that halves every 4 years. Therefore, not only is Bitcoin unable to print more coins when it so pleases, fewer and fewer coins are released into the system as time goes on.

A stark contrast to the situation most fiat currencies find themselves in.

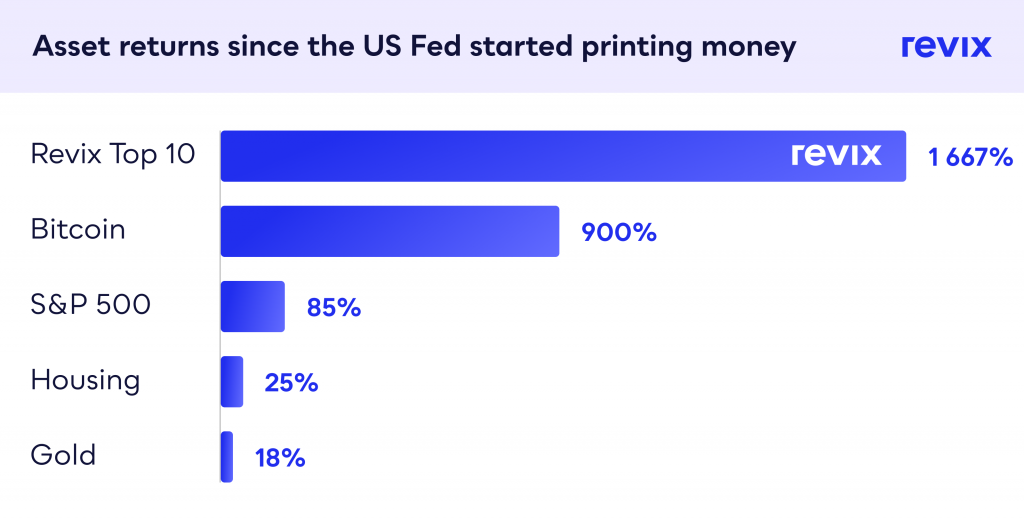

Let’s take a look at how Bitcoin has compared to traditional inflationary hedges since the US started to print money. Could it really be a safer bet than the old stalwarts gold, housing, or even shares?

Not that the graph above needs much explaining, but the answer is a resounding yes.

As a standalone cryptocurrency, we can see that Bitcoin (+900%) has outperformed S&P 500 (+85%), The US Housing Index (25%) and Gold (+18%), respectively.

But there seems to be an even bigger winner – The Revix Top10 bundle.

Much like the S&P500 – the Revix Top10 bundle (+1,667%) gives investors diversified exposure to the top 10 cryptocurrencies as measured by market cap. This includes equal exposure to the likes of Ethereum, Solana, Bitcoin and many others.

“This shows you that not only do cryptocurrencies keep up with inflation and traditional inflation hedges, but they make them look immaterial. Cryptocurrencies, such as Bitcoin, have helped many people combat the US monetary printing by owning an asset that has far greater returns than the rate at which US Dollars are being printed.” Hope Robertson continues.

A revolutionary investment

For people tired of being the victims of inflation, cryptoassets represent an unprecedented opportunity. What other asset class offers the opportunity to effectively protect your wealth from inflation while investing in an alternative to the very system driving that inflation.

Incredibly, despite the massive influence they have already had on the world, the most significant technologies defining the world of crypto are still in their infancy. The opportunity to become an early investor in the future of the next global financial system is still available to everyone.

Revix – Zero Purchase Fees on Revix Bundles

Choosing which crypto technologies to back requires a time commitment that most working people simply can’t afford though.

That’s why Revix, a crypto investment platform based in Cape Town, created its Crypto Bundle offerings. Revix’s Bundles allow investors to instantly purchase a diversified portfolio of the top cryptoassets by market cap.

Between the 12th of November and the 18th of November, you’ll pay zero fees when you buy the Top10 Bundle, Smart Contract Bundle or the Payment Bundle with ZAR or GBP.

There’s no easier way to use crypto to hedge against inflation while getting involved in the future of the world’s financial systems.

Revix is backed by JSE listed Sabvest and offers access to all of the individual cryptocurrencies and bundles mentioned in this article.