Nedbank has partnered with Mastercard and local fintech company Ukeshe to launch a WhatsApp payment feature for businesses in South Africa. Users will be able to pay merchants for goods and services directly through Facebook’s messaging app.

“The need for a diverse range of contactless payment methods is more important today than we could have possibly imagined, as we seek to rebuild the economy by giving businesses the ability to transact in a safe and secure way,” says Chipo Mushwana, executive of emerging payments at Nedbank.

It’s WhatsApp money

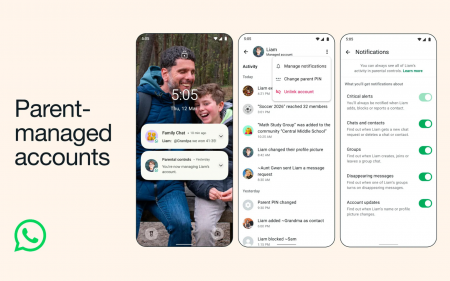

The new feature is called Money Message, and allows small and micro-sized businesses in the country to accept payments directly from clients without the need for an online portal or an EFT. According to Nedbank, the feature is specifically aimed at helping smaller businesses improve their e-commerce offering through an already-established messaging platform. It also helps that it’s the most-used messaging platform in the world, right?

The new feature is called Money Message, and allows small and micro-sized businesses in the country to accept payments directly from clients without the need for an online portal or an EFT. According to Nedbank, the feature is specifically aimed at helping smaller businesses improve their e-commerce offering through an already-established messaging platform. It also helps that it’s the most-used messaging platform in the world, right?

Read more: Nedbank releases a shopping app called Avo that could help small businesses through lockdown

“In order to support entrepreneurship and sustainable business growth across all markets, we need to deliver low-cost, accessible and flexible solutions that leverage widely accessible technologies. Money Message looks to overcome a variety of cost, security and technical barriers by enabling micro-merchants and their customers to transact with each other easily on an existing platform, which is WhatsApp.”

Through the feature, merchants will be able to send an invoice to a customer directly in WhatsApp, after which the customer can complete payment, also right in the app. This all means neither party really ever has to leave WhatsApp and can just live in there. Facebook must be thrilled.

You’ll need a South African ID document and a local bank account to set up the feature. However, it doesn’t look like it has to be a Nedbank account, and should work with any local bank account. While the feature is only currently open to a small number of micro-businesses, Nedbank is planned to reach a wider audience during 2021.