In case you are a small business looking for ways to send and receive international payments, this article will share five different international payment/money transfer services that you should look into. Some facilitate payments to and from South Africa, while others are receive-only or send-only services.

All of the services on this list are properly registered with South African financial authorities and are backed by South African banks and companies. They use the latest in online security to keep your money — and the money of your customers and suppliers — as safe as possible. That should give you the confidence you need to give them a try.

At the end of the article, if you’re still sceptical, have a talk with your business bank to get their blessing or to get a suggestion for a payment service that might be better for your peace of mind or business model.

Mama Money

Website: MamaMoney.co.za

Interface: iOS, Android

Mama Money is an app-only money transfer service that lets South Africans send money to bank accounts and mobile wallets in 50 countries in Europe, Asia, and Africa. In addition to an Apple or Android cell phone, you will need a South African ID, a foreign ID, a passport, or asylum/refugee papers to register.

After activating your account, you will have the ability to send up to R5000 per transaction and up to R25,000 per month. Upgrading your account lets you send more, with higher limits of R50,000 per transaction and R100,000 per month.

Transfers to mobile wallets and cash collection are typically processed and delivered within minutes, ensuring fast access to the funds. Mama Money’s fees are typically 5% or below, depending on the destination for the funds, which is slightly higher than other options in this list.

Transfers to bank accounts generally have an average processing time of 5 hours to be received, but the exact timing may vary based on the recipient’s bank. In some cases, it may take up to 48 hours for the transfer to fully reflect in the recipient’s account, depending on their bank’s internal processes.

The supported countries are primarily European, so this service is good for companies that need to make regular payments to European suppliers. But it’s also good for getting money to parties in India, Pakistan, and Bangladesh, as well as Africa’s more economically developed countries.

Shyft

Website: GetShyft.co.za

Interface: Browser, iOS, Android, Huawei App Gallery

Shyft, backed by Standard Bank, does more than just facilitate international money transfers: it lets you buy foreign exchange; it supports virtual cards for online shopping; it lets you order a physical card that you can use for in-person shopping; and it lets you buy shares in global companies like Amazon and Apple and manage them all from the app. You can even access and manage your offshore accounts with it.

Money transfers, which is what we’re interested in for this article, are charged at a flat rate for each transaction, depending on the currency involved.

For transfers to standard international bank accounts, Shyft’s standard fees are as follows:

- USD payments – USD 14.00;

- GBP payments – GBP 10.00;

- EUR payments – EUR 12.00; and

- AUD payments – AUD 18.00

Where Shyft is unique is that it offers a “Shyft to Shyft” function that lets you send immediate and free money payments to other Shyft users, no matter where they are in the world. Shyft limits users to sending a maximum of R1 million per year.

You’ll need to verify your identity and supply them with all of the necessary documentation before you can begin transacting, but that’s standard for all financial apps at this point so there’s no surprise here.

For a local business with international clients that use Shyft, Shyft is a handy option when it comes to sending and receiving international payments. It’s also useful for non-Shyft transfers thanks to their 1.5% fee regardless of transaction size. The other things it does could also prove highly beneficial to businesses that have need of those things.

Note: When this article was first published, it said that international transfers were charged at a flat fee of 1.5% of the total amount. This was incorrect, and we have amended the text to reflect the correct rates, as provided to us by Shyft. Stuff Business regrets the error.

Wise.com

Website: Wise.com

Interface: Browser

Wise.com is a great way for local businesses to receive international payments. The nice thing about Wise.com is you can receive the equivalent of up to 1 million GBP, which, at R23.93 to the pound, is a whole lot of money.

After registering for an account and filling out a form called a mandate, you’re ready to receive money from overseas. The mandate is sent to the South African Reserve Bank to legitimise you as a recipient, but it only needs to be done once.

Transfers typically take about a full business day to reach you after the initial payment reaches Wise.com and the conversion is done. Conversions, the site says, can take up to 2 working days. Once you receive the notification that the payment has been made, a day later, the money reflects.

Wise.com is a great way for freelancers to receive payments from overseas, but there’s no limit on the type of South African company that can use it to receive payments. At the time of writing, it’s not possible to send ZAR to other countries with Wise.com, so this is a receive-only money transfer service.

Remitly

Website: Remitly.com

Interface: Web, iOS, Android

Remitly is an American money transfer service that’s headquartered in Seattle, Washington. It’s a great option for South African businesses that have customers in the US, as South Africa is one of the countries where Remitly can send money.

While Remitly was set up to help expats working in the US send money back to their home countries, there’s no reason why it can’t be used by Americans to pay for goods from or send payments to South African companies, and South African companies to send money abroad.

Payments can be sent to bank accounts, mobile wallets M-Pesa, MTN Mobile Money, etc.), and cash pickup points. The website says Remitly charges $1.99 per transaction, which is about R39, and that’s the same for both Express and Economy sends. When it comes to limits, you can send up to $2,999 daily, $10,000 monthly, or $18,000 over a 6-month period. Any limit on the amount you can receive is up to your bank.

Money sent to mobile wallets usually takes minutes, they say, and transfers to bank accounts generally take three to five business days.

With legitimate local finance partners ready to help you with your transfers, Remitly is a great option for businesses looking for a trustworthy international transfer provider.

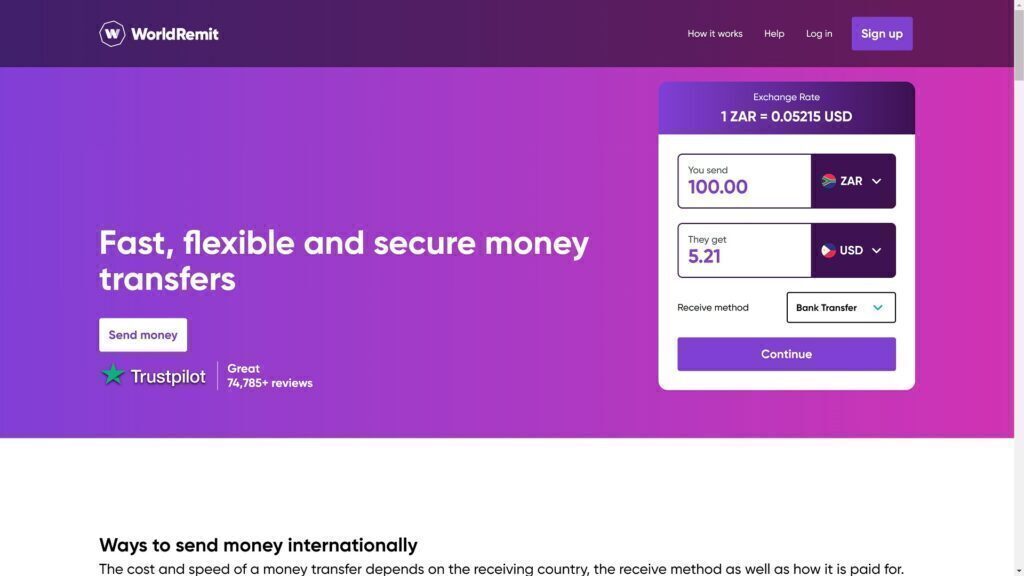

WorldRemit

Website: Worldremit.com

Interface: Web, iOS, Android

The WorldRemit service offers money transfers to and from a variety of countries, with two options as to how to receive the money – directly into your bank account, or as a cash pickup from participating retail stores or Standard Bank ATMs.

Their rates are pretty low, coming in at a small percentage of the overall amount. When you set up the transfer and enter the amount you want to send (or the amount you want a recipient to receive), the service does the calculation for you, taking into account the small percentage WorldRemit charges for the service.

Right now, for example, if we send someone in the US R100, they will receive $5.20. The difference between that $5.20 and what R100 is worth when you do a direct conversion is R97.94, which means WorldRemit takes R2.04 for the service. This is congruent with their claim that they are “on average up to 46% cheaper than most banks”.

To receive the money, the recipient needs to register a profile on Worldremit.com and verify their identity. This means submitting their national ID, a photo, and verifying their cell number; this takes “a few minutes” according to the site. Worldremit also says transfers typically go through in minutes, but money sent to bank accounts can take up to two days, depending on your bank.

Transfers can be funded either with a direct deposit into WorldRemit’s account, or with a debit or credit card for convenience. One potential downside of using Worldremit is the relatively low send limits: the maximum send amount per month is R24,999, and the maximum send amount per transfer is R4,999. The maximum amount you can receive via Worldremit in a single transfer is R50,000 and requires paperwork from the sender to collect.

Businesses that need to send payments to overseas suppliers and receive payments from international customers should find Worldremit trustworthy, easy to use, and fast.