A pitfall that many first-time investors fall into is underestimating the importance of filtering the information that they pay attention to. In the wild world of crypto, this challenge is made all the more difficult by the sheer volume of media coverage, and the fact that any significant price movement invariably triggers a speculative media storm.

Amidst the deluge of often conflicting messages, how can a new investor differentiate between media hype and information that should define their investment strategy? The crypto community’s answer (as is often the case) is an acronym: DYOR.

Do Your Own Research has come to mean more than the obvious. It is a call for investors not to blindly board the hype train and invest in whatever happens to be the crypto media’s current crush. Instead, take the time to look beyond the news on the front line and focus on information that holds more weight when it comes to understanding the long term potential of a cryptocurrency.

Now that’s sound advice, but what kinds of information should the savvy investor be keeping an eye on? In this article, we look at just some of the ways in which paying attention to what institutional investors are doing can transform your approach to your crypto investments.

What are ‘Smart Money’ funds and why should we care?

An institutional investor is a company or organisation that invests money on behalf of other people. These can include mutual funds, pensions, and insurance companies. Institutions like this have access to sizeable pools of funds, and just one buying or selling an asset can have an impact on its price. However, these institutions are also burdened by investor mandates and extensive red tape when making new investments, so they tend to move very slowly.

In order to spot trends, we are better served by following more dynamic institutional investors such as hedge funds, asset managers and venture capital funds. These funds are what we call ‘Smart Money’, and they are exactly what you want to follow if you’re looking to spot the next trend in any market.

Now you may be asking why you should pay attention to what investors with multi-billion dollar portfolios are doing. After all, if you had that kind of money, you’d likely be picking which island to moor your superyacht on, rather than reading this article.

The fact is, in many ways, following ‘Smart Money’ funds is essentially following the world’s most skilled and advanced investment analysts. After all, that’s why these funds are known as ‘Smart Money’.

When we see trends in ‘Smart Money’ begin to emerge, that means that multiple funds have reached the same conclusion on where they believe the next area of growth will be. For the average investor, that information is worth its weight in bitcoin… sorry, gold.

Following ‘Smart Money’ to the real crypto trends

At last count, there were over 6000 different cryptos in circulation. Even the list of the top 10 by market value changes on a weekly basis. So how is it possible to make an educated choice of where to invest? This is where looking at trends in institutional investments can be a game changer.

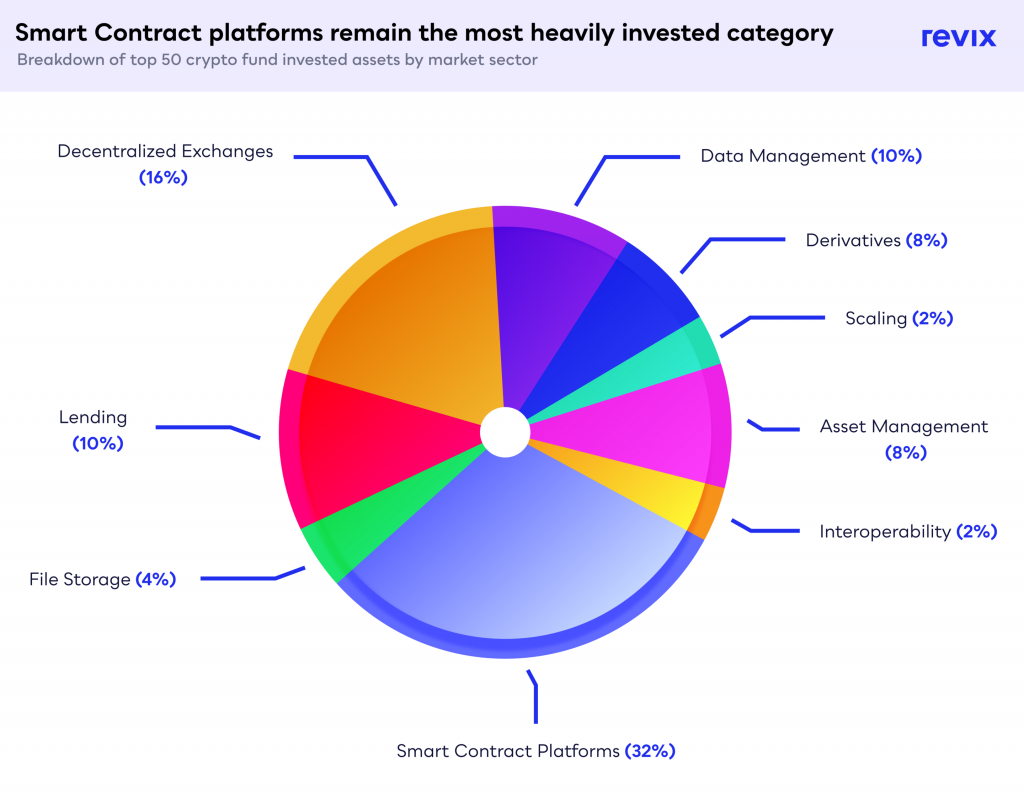

The graph above shows which sectors of the crypto market the top 50 crypto funds are invested in. A glance at this chart shows smart contract platforms to be the most heavily invested category, but upon closer inspection the story isn’t that simple.

Decentralised Finance (DeFi) is a sector made up of lending (10%), decentralised exchanges (16%), derivatives (8%) and asset management (8%). Combined, these make up 42% of the investments in these categories.

So it is, in fact, DeFi that takes the number one spot.

How can you build an investment strategy based on this information? Firstly, narrow down your choices to the leaders in a particular crypto market segment. If the graph above is anything to go by, that would be the DeFi and smart contract sectors. These sectors include cryptos like Uniswap, Aave, Ethereum, Luna and Avalanche. From that point, you could opt to go all in on the market leader, like Uniswap or Ethereum, or you could diversify and spread your portfolio over the leading blockchain technologies in the DeFi and smart contract sectors.

The same approach could be applied to any of the other crypto market sectors that you may be personally interested in.

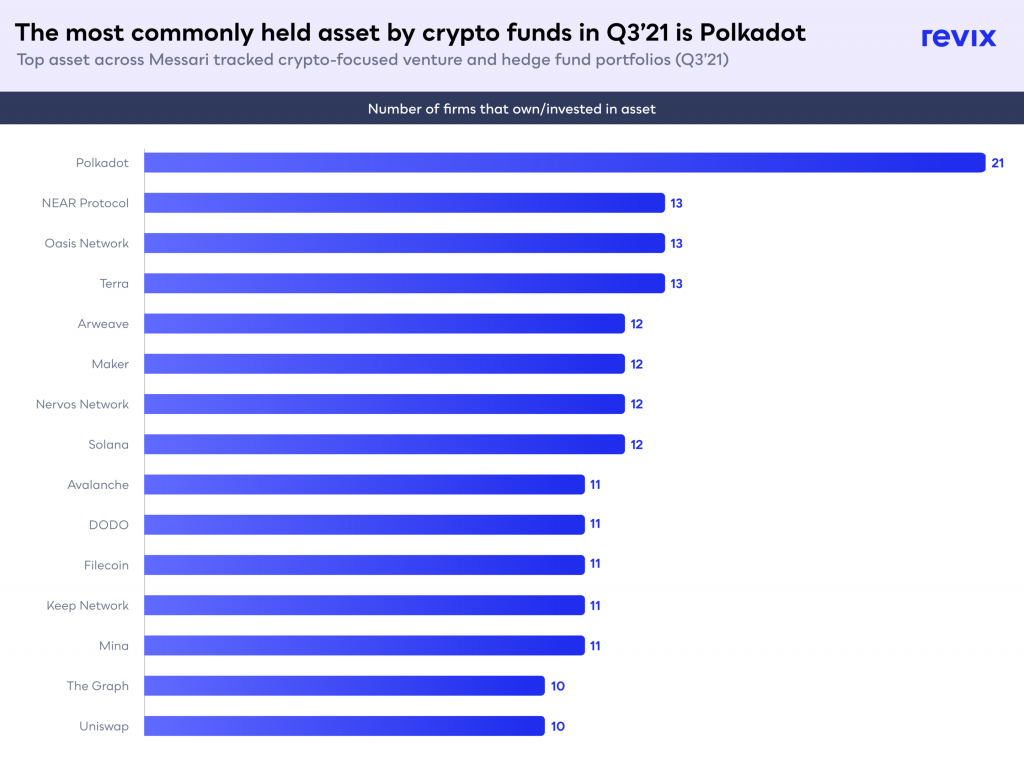

Of course, it is also possible to look at which individual cryptos have attracted the most institutional investment.

The graph above shows the cryptos that attracted the most investment from crypto-focused venture and hedge funds in Q3 of 2021. Note that this graph excludes heavyweights Bitcoin and Ethereum. If you had to choose which crypto to invest in during this time period, the fact that Polkadot was so heavily favoured among institutional investors would be a far more valuable signal than that one article you read on a crypto news site.

Who has time to stalk institutional investors?

Hopefully this article has made you more aware of some invaluable data which can help you build a more stable and level-headed approach to your crypto investments. It’s at this point, however, that many investors ask, “who on earth has the time to DYOR?”.

A legitimate problem, but fortunately, it’s one that Cape Town-based crypto investment platform Revix has set out to solve. Revix’s claim to fame are its Crypto Bundles, which offer investors an alternative to doing their own comprehensive research to decide which cryptos are best to hold for exposure to certain market sectors.

For example, if as we discussed above you wanted to invest in the smart contract sector, Revix makes that possible with one simple investment. The Smart Contract Bundle tracks the top cryptocurrencies in that sector and is automatically reweighted monthly. This eliminates the need for you to constantly stay up to date with what is happening, while remaining invested in the best-performing cryptos in that sector. Learn more about the Smart Contract, Top10 and Payment Bundles on Revix’s website.

Reap the rewards of financial fitness in 2022

Starting on the 10th of January, we’re challenging Revix investors to commit to a financial fitness challenge. Forget about building biceps, we’re helping you build wealth. Each week, we’ll ask you to perform a number of actions on the Revix platform, and you’ll unlock rewards for completing each one.

Investing is a marathon, not a sprint. So join us for the Revix Financial Fitness Challenge, and by the end of 2022, you’ll have more to show for your dedication to fitness than a dusty pair of running shoes.