When bitcoin was trading at the dizzying heights of almost US$20,000 in December 2017, it was the peak of the previous bull run in cryptocurrencies. It was a classic bubble, in line with the work on such phenomena by the American financial economist Hyman Minsky, and investors should arguably have seen it coming. It was not until late 2018 that bitcoin finally bottomed out at slightly above US$3,000, though for many the “crypto winter” dragged on for much of 2019 as well.

Several ups and downs later, the bull market looks to be back. Since the turn of the year, bitcoin has climbed from just over US$7,000 to the low US$10,000s. Few asset classes can boast a rise of about 40% in six weeks, though bitcoin enthusiasts like to point out that bitcoin is the best performing asset of the past decade – however choppy the journey along the way.

Having said that, bitcoin is certainly not where you would have made most money if you had bought cryptocurrencies at the start of January. There have been even greater price gains from leading altcoins such as ethereum (+119%), ripple (+58%), bitcoin cash (+109%) and bitcoin SV (+222%). So what explains their superior performance?

Bitcoin dominance

These four altcoins are the largest cryptocurrencies on the market after bitcoin, representing an aggregate US$51 billion market capitalisation (the value of each coin multiplied by the number of coins on the market). This is still fairly small compared with bitcoin’s US$178 billion market cap, but clearly the gap has been narrowing.

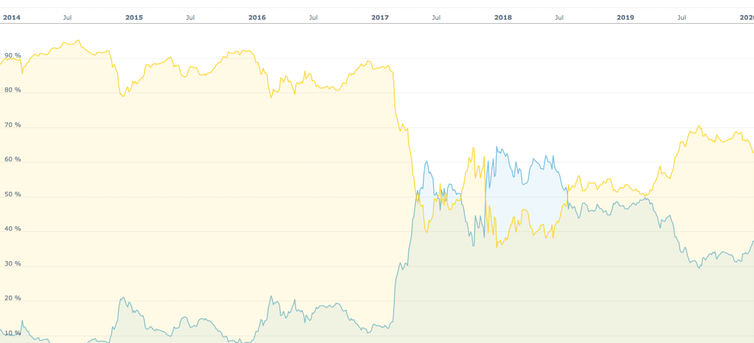

Cryptocurrency aficionados compare bitcoin and the altcoins in terms of bitcoin dominance. This refers to bitcoin’s market size compared with the rest of the altcoins put together. During the early weeks of 2020, it fell slightly from 68% to 64%. As the chart below shows, this is a shift from what has happened for most of the past couple of years.

Bitcoin dominance

For years, there has tended to be a statistically significant correlation between the performance of bitcoin and the altcoins: when bitcoin rises or falls in price, most altcoins tend to do likewise. You can track this using online tools, such as Coinpredictor.io.

Despite this correlation, altcoins have tended to underperform bitcoin ever since the previous bull market petered out in winter 2017-18. Bitcoin dominance was only 39% at the beginning of 2018, whereas it had risen to 70% by July 2019 and stayed around that range for most of the rest of the year.

This suggests that bitcoin has acted as a safe harbour for many investors still smarting from the bubble and pop of 2017, which was fuelled by an explosion of initial coin offerings or ICOs from new currencies entering the market. Those who didn’t get out of cryptocurrencies altogether probably felt the need to consolidate around an asset they trusted. Bitcoin was the obvious choice as the longest established and most widely traded asset in this class, and also the gateway cryptocurrency for many investors – their first dip of a toe in the water en route to an altcoin purchase.

Other writers have pointed out that during 2019, the price correlation between bitcoin and the altcoins declined. As many other cryptocurrency projects failed to live up to the heady expectations of a year or two before, investors perhaps traded them for bitcoin in a “flight to quality” – a little like traditional investors switching to the likes of gold when the stock market dives.

Flight to altcoins?

The tilt back towards altcoins in the first weeks of 2020 may be the start of another bull-run, driven by a renewed confidence or understanding in the space. Recent favourable commercial developments have bolstered prices, such as JP Morgan’s positive progress with the interbank payments system that it runs on the ethereum network.

The rise of the altcoins is also possibly being fuelled in part by an increasing number of coins entering the market. According to coinmarketcap, it now staggeringly numbers over 5,000. All other things being equal, this should reduce bitcoin dominance – this may be feeding through now that confidence has risen in the sector as a whole.

There has also been a sector-wide boost from Coinbase, the largest cryptoasset exchange in the US. Coinbase is making a play for institutional investors by expanding its ability to store digital coins on their behalf outside the US. Known in the jargon as custodial solutions, Coinbase’s offering has just received two major industry kitemarks from leading accounting firm Grant Thornton, so may be attracting more institutional money into the sector.

Another factor may be eagerly awaited initiatives from leading players such as the ethereum 2.0 launch, which looks set for July 2020. This major upgrade to the second-largest crypto network, which underpins many cryptocurrencies and enterprises in this space, is expected to make a big difference to transaction speeds among other things.

One big question is whether bitcoin will start outperforming the altcoins again thanks to the so-called “halvening”, which is expected in May. This is the moment roughly every four years when the reward to bitcoin miners is halved, thereby reducing the number of new bitcoins available to sell on the market.

Writers such as Jemima Kelly in the Financial Times make a strong case that this won’t raise the bitcoin price because the number of coins in circulation will still be rising and the event is built into the system so should be accounted for in the price already. Yet in a young market, which is comparatively thinly traded and has no uniform global regulation, the positive sentiment around this event may have more effect on the price than the fundamentals.

We have previously argued in The Conversation that the chances of bitcoin replacing the global financial system have probably ended, now that many countries and multinationals, such as Facebook, are planning to launch cryptocurrencies of their own. All the same, the latest bull market is more evidence that bitcoin is likely to persist on the peripheries, probably along with the cream of the altcoins.

Whether those altcoins can continue to outperform their bitcoin matriarch is a difficult question to answer, but they are showing encouraging signs of life. Naysayers who have predicted their steady demise may have spoken too soon.

- is Senior Lecturer, Finance, Manchester Metropolitan University

- is Research Fellow in Economics, Manchester Metropolitan University

- This article first appeared on The Conversation