Just as you think we have enough banks in South Africa, another one peeks its sneaky head out. The same is true for Bank Zero, ex-FNB CEO Micheal Jordaan’s new zero-fee bank. It’s taken its time to launch officially, but the fee structures have been revealed for the digital bank, and tickle us impressed.

A few months ago Bank Zero launched internally and was available to a small group of customers in a closed beta. We do know that it will launch officially in 2021, so these tests were clearly conducted to iron out any issues the system may have before the official launch.

As the name suggests, Bank Zero won’t charge monthly banking account fees. It sounds relatively similar to opposing digital bank Tymebank, but according to Bank Zero CEO Yatin Narsai Bank Zero features a patented bank card that’ll set them apart from other digital banking offerings.

As the name suggests, Bank Zero won’t charge monthly banking account fees. It sounds relatively similar to opposing digital bank Tymebank, but according to Bank Zero CEO Yatin Narsai Bank Zero features a patented bank card that’ll set them apart from other digital banking offerings.

Bank Zero’s pricing

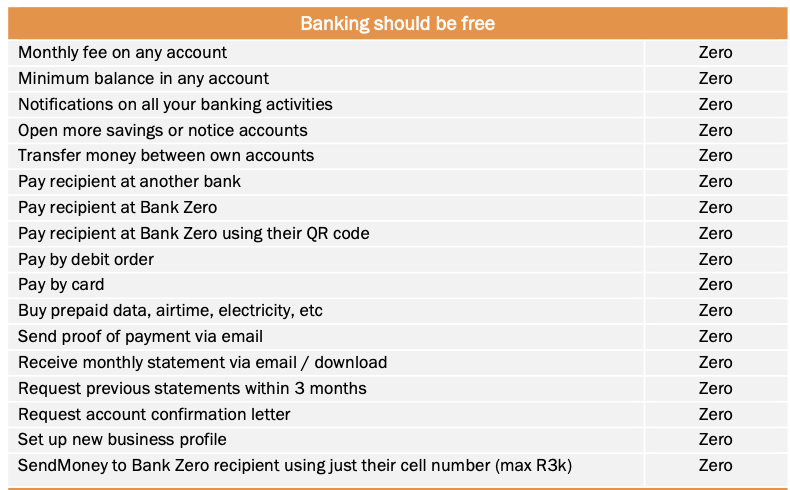

Everything from monthly bank account fees to the minimum balance, notifications, transferring money within accounts and paying other Bank Zero recipients will cost nothing. Fees are marked as ‘zero’ for all of these functions. There are a few things, however, that you’ll need to pay for.

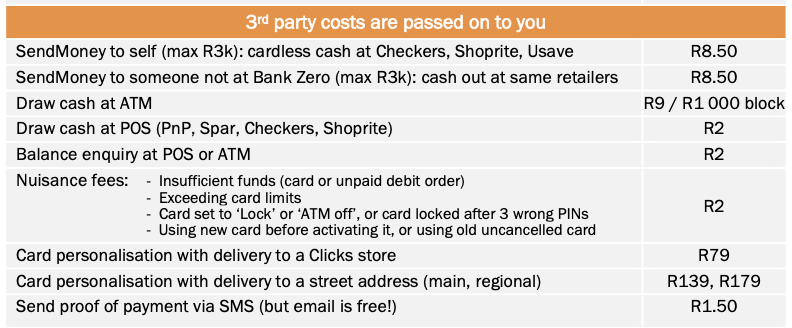

If you send money to yourself and withdraw it at Checkers, Shoprite and Usave, there is a once-off fee of R8.50. Same goes if you transfer money to someone that does not bank with Bank Zero. Drawing cash at an ATM will run you R9 per R1,000 withdrawn while drawing money from a POS at any grocery retailer will cost R2.

If you send money to yourself and withdraw it at Checkers, Shoprite and Usave, there is a once-off fee of R8.50. Same goes if you transfer money to someone that does not bank with Bank Zero. Drawing cash at an ATM will run you R9 per R1,000 withdrawn while drawing money from a POS at any grocery retailer will cost R2.

One of the cool features is that Bank Zero will allow for card personalisation for an additional R80 — after which your card can be shipped to a Clicks store at no additional charge. The same goes for a personalised card, but delivered to a street address (ie your home) will cost you R140 or R180 depending on your region.

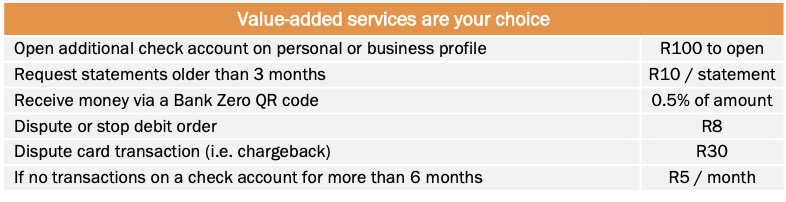

It also features some value-added services that are completely optional — those you’ll pay for. If you want to open a checking account it’ll run you R100. Requesting statements will cost R10 per statement and when you dispute a debit order you’ll pay R8.

It also features some value-added services that are completely optional — those you’ll pay for. If you want to open a checking account it’ll run you R100. Requesting statements will cost R10 per statement and when you dispute a debit order you’ll pay R8.

Although its products and services aren’t completely free, Bank Zero seriously goes out of its way to make its banking system affordable and accessible to anyone. We look forward to seeing it grow in a densely populated banking environment in South Africa come launch in 2021.