While FNB South Africa’s customers are basking in the glow of their bank’s recent eBucks upgrades (and subsequent dismissal of tap-to-pay functionality), other banks are searching for a win. We think Absa’s launch of ChatWallet – the sequel to its 2018 ChatBanking feature – fits that bill. The bank announced and launched ChatWallet yesterday, giving users access to “quality banking services” – all through WhatsApp.

Flying cars? Nah. Banking on WhatsApp

ChatWallet is here! Absa’s new smart and convenient banking solution that allows you to chat and bank through WhatsApp. Sign up for ChatWallet and tell us what you love the most about it. Reply using #WeDoMoreWednesdays and a ❤️ emoji <https://t.co/8D27C1oOWR> #MyBankDoesThat pic.twitter.com/pMRtSlEMz4

— Absa South Africa (@AbsaSouthAfrica) February 7, 2024

“…the innovative ChatWallet platform not only simplifies transactions but opens doors to a broader spectrum of banking services. With ChatWallet, users can securely manage money without the need for an existing bank account, bridging the gap to financial inclusion. The menu’s standout feature allows a smooth transition to a transactional bank account, unlocking the full potential of digital banking services for all,” says Nick Nkosi, Absa’s managing executive.

All it needs from you is a working RICA’d cell number that’s linked to WhatsApp, a valid South African ID number, a phone with a selfie cam, and a birth date pre-dating 8 February 2006. In other words, you need to be at least 18 years old. If you’ve got all that going for you, you’ll be able to use ChatWallet to send and receive payments, purchase airtime and data bundles, handle beneficiaries, and “conduct seamless cash withdrawals and deposits.” You don’t even need a bank account to get going, Absa or otherwise.

As Absa puts it: “It’s not just a wallet; it’s your all-in-one solution for hassle-free and versatile banking on the go.”

Absa’s included a full list of the features and benefits available through ChatWallet:

- Quick and easy access via WhatsApp,

- One of the most secure wallets on the market with biometric verification,

- Secure storage of funds,

- Receive money via ChatWallet (up to R25 000),

- Pay family and friends,

- Free day-to-day banking – zero monthly fees,

- Free ATM cash deposits,

- No charge for prepaid electricity, airtime, and data purchases,

- 1 free CashSend per month,

- Lowest pay-as-you-transact costs for payment to a cellphone number and CashSend to self ATM withdrawal and EFT payment to bank account,

- Ability to view wallet details and transaction history, change your ChatWallet PIN and recall unredeemed CashSend payments,

- Ability to upgrade from ChatWallet into a transactional account and join Absa Rewards for free,

- Covered by Absa’s free Digital Fraud Warranty.

Read More: FNB ending tap-to-pay smartphone functionality

How to use ChatWallet

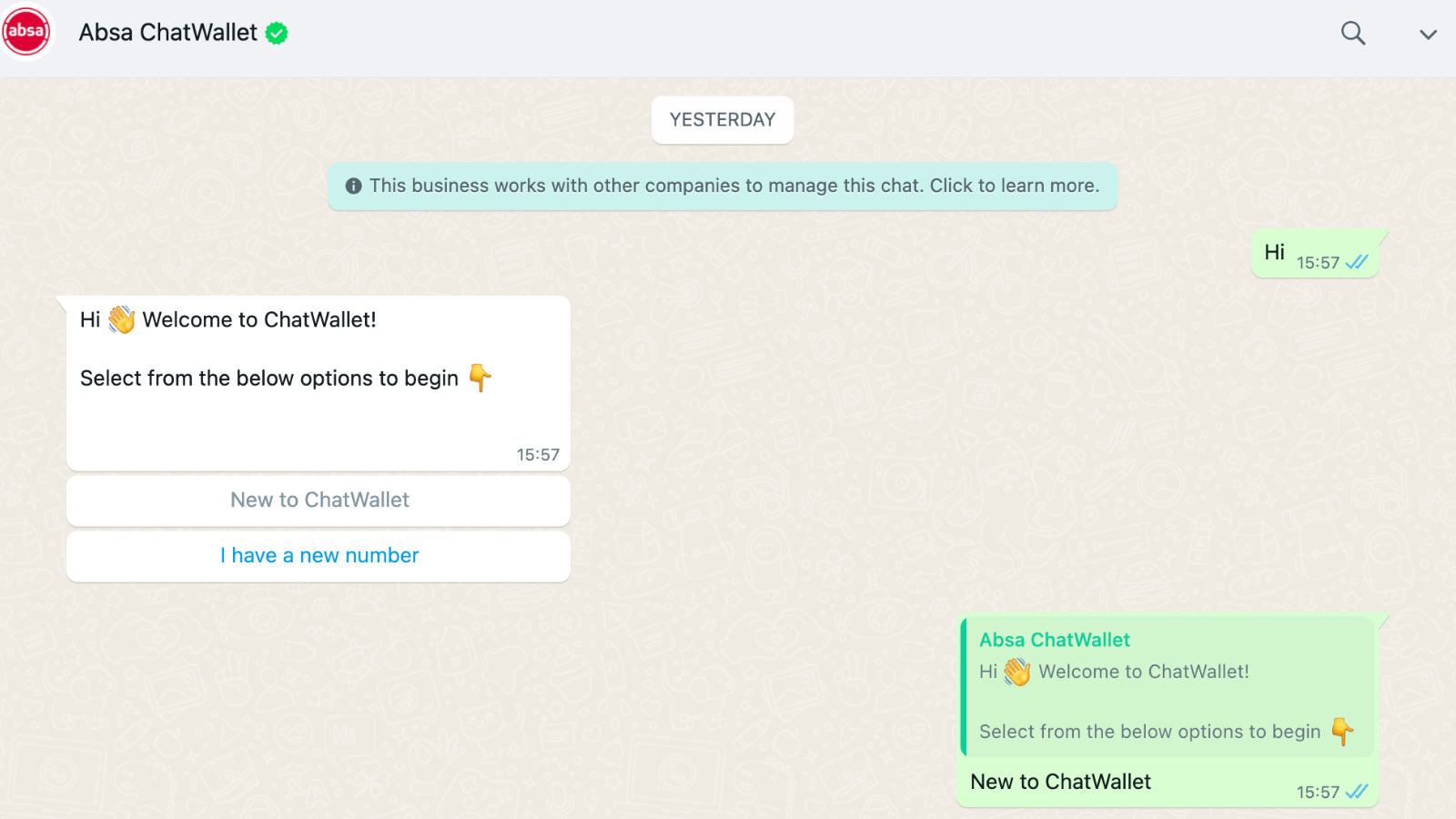

As for how to use ChatWallet, it’s as simple as sending a message saying “Hi” to this number – 086 000 2428 – on WhatsApp. You’ll be prompted with a short greeting and two options to get started. Choose between “New to ChatWallet” or “I have a new number”.

Most customers will select the “New to ChatWallet” option, after which they’ll be introduced to Abby, the bank’s virtual assistant. Follow the prompts as instructed, accepting the necessary Ts & Cs and Personal Client Agreement and entering your ID number. Click the available link, where you will be taken to Absa’s website to scan your face and “check your identity with the Department of Home Affairs.”

The face-scan process can be completed in under a minute, after which you’ll be asked to confirm your details, such as your name, phone number, occupation, and source of funds for the wallet. It was here that we ran into our first issue when changing our occupation, requiring painstaking effort and a whole load of prompts to do so. Fortunately, this is a once-off process that can be skipped after the initial setup.

You’ll need to reactivate Abby with another “Hi” message, where you’ll be given the option to “Start banking”. This will take you to an online portal and requires a digital PIN or you can hit the “Main menu” to make payments, buy, or add money to your wallet, among other options.