If ever there’s been a bank that likes to build the hype, it’s Bank Zero. Detailed as a ‘controversial’ zero-fee bank back in 2018, Bank Zero has since gained quite a lot of competition for its banking model.

South Africa’s banking sector has evolved at great lengths in recent years — newbies Discovery Bank and TymeBank have shaken up the industry, and traditional banks have attempted forced evolution at its mercy. Some have done so fairly successfully too.

Bank Zero’s rocky path to launch has been riddled with icebergs, the main one being COVID-19 and its effect on working conditions. Late in 2020, the bank launched internally as a beta. Only a select few were able to sign up and use the bank — most of ‘em employees. Now the financial service is ready to launch proper.

While it’s taking applications from the general public, executives say that it’s throttling the number of people signing up to ensure its “seamless onboarding experience is not overwhelmed.”

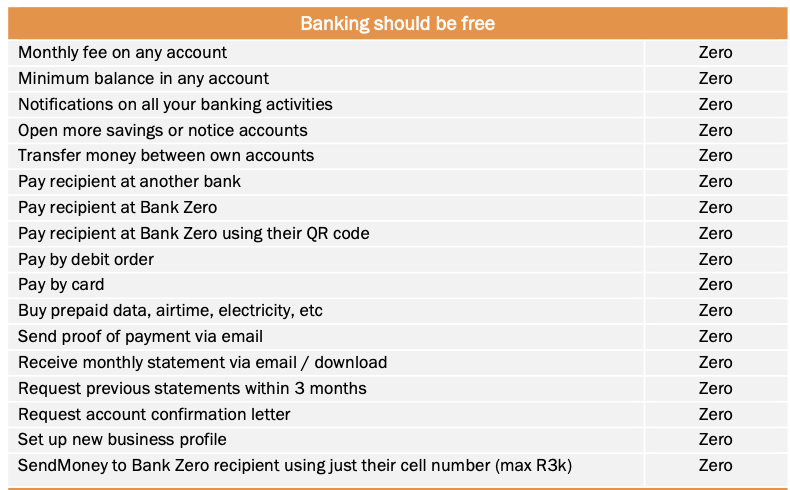

Bank Zero pricing — it’s not always zero

If you send money to yourself and withdraw it at Checkers, Shoprite and Usave, there is a once-off fee of R8.50. Same goes for if you transfer money to someone that does not bank with Bank Zero. Drawing cash at an ATM will run you R9 per R1,000 withdrawn while drawing money from a POS at any grocery retailer will cost R2.

One of the cool features is that Bank Zero will allow for card personalisation for an additional R80 — after which your card can be shipped to a Clicks store at no additional charge. The same goes for a personalised card, but delivered to a street address (ie your home) will cost you R140 or R180 depending on your region.

It also features some value-added services that are completely optional — those you’ll pay for. If you want to open a checking account it’ll run you R100. Requesting statements will cost R10 per statement and when you dispute a debit order you’ll pay R8.

The fledgling bank offers an impressive pricing structure across all of its products, but it’ll be interesting to see how it manages to keep its costs low at scale. All while keeping up with major banks and new entries that are bound to enter the market.