Gather the millennials and the toast, because our favourite green fruit is now available as an app from Nedbank. You might not want to spread this one on a fresh piece of toasted bread, though you can buy some normal bread directly from the app.

Nedbank announced that it is launching “a tech-based solution that revolutionises the way South Africans shop and sell”. Which just means that it’s launched a new eCommerce app filled with a variety of online shopping options, specially designed for South Africans.

“Today’s banks have an opportunity and a responsibility, to do far more for their customers than merely provide financial services. Platform ecosystems are the perfect way for them to deliver these comprehensive value propositions that their customers deserve,” says Ciko Thomas, managing executive of retail and business banking at Nedbank.

Gimme Avo

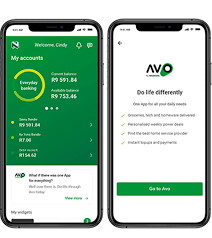

Avo is Nedbank’s brand new API Marketplace, or a ‘super app’ as the company calls it. It’s a combined marketplace app that integrates of a bunch of shopping options into one app. This includes the ability to order essential goods and food with OneCart (guess what that does), home entertainment shopping as well as access to home service providers. The whole thing is optimised for lockdown at the moment, with all service and goods deliveries complying with all levels of lockdown and the rulesets that go with them.

Avo is Nedbank’s brand new API Marketplace, or a ‘super app’ as the company calls it. It’s a combined marketplace app that integrates of a bunch of shopping options into one app. This includes the ability to order essential goods and food with OneCart (guess what that does), home entertainment shopping as well as access to home service providers. The whole thing is optimised for lockdown at the moment, with all service and goods deliveries complying with all levels of lockdown and the rulesets that go with them.

According to Nedbank, this platform is exactly what struggling small businesses need to continue delivering services during the pandemic. Using the app, service providers (that are licensed to operate, we’re guessing) can connect with clients who need those services. “To date, Avo has reached the milestone of over 5,000 customers registered and 170 registered Home Repair and Services merchants.”

The Avo app is still in beta, but is available for Nedbank Money App users now. All you have to do is go through a “two-click process to sign up seamlessly”, according to a press release. A full rollout to the public will happen when Nedbank feels the platform is ready.