“There hasn’t been any change in the employee benefit space in 15 to 20 years,” says Jaco Oosthuizen, the co-founder and MD of YuLife South Africa. “It’s up for disruption.”

Meet YuLife, a new player in the South African digital group insurance space offering income protection, funeral cover, and lumpsum disability. Founded in 2016, Oosthuizen joined the company with the idea that one day, he would be able to bring the company (and its giraffe mascot, Yugi) home. “South Africa has the second highest insurance penetration in the world. It’s the largest and most established insurance market in Africa,” says Oosthuizen.

YuLife may offer the same product range as other insurance companies (with more to come, later this year) but their proactive, simplified business model is run through an app, and that is what makes the company stand out.

Transforming traditional employee benefits

The company’s ecosystem revolves around a gamified app and one of the reasons for this is that Josh Hart, YuLife’s co-founder, and CPTP, used to log onto his computer every night after school to play games like World of Warcraft. “It’s something I looked forward to every day and it was a big part of life for me,” he says. But when he grew up, he started doing tax returns and time sheets and technology no longer gave him the same pleasure he had as a kid. “To this day, I’m still very sad that technology can be something that gives us such pleasure in our everyday life and be worthy of our time, and yet, so many traditional services do it in such a painful way,” he says.

For Hart, he wanted to create an app that people would be excited to log into every day, an app where the main character you’re trying to power up and incentivise is actually yourself. To do this, you need Yucoin, YuLife’s “currency of wellbeing”. You are rewarded with Yucoin for completing simple daily activities (daily steps, mindfulness, etc.). To do five minutes of meditation, you can connect to a popular app that you already use like Calm or Headspace, or choose to use what the YuLife supplies in-app – in this case, it’s a session by Meditopia. “The quests are a lot like Candy Crush’s progression system – we have thousands and every day, you can do a quest,” adds Marks.

But you also don’t need to open the app daily – if your phone is already tracking your steps or connected to a fitness wearable, that activity will synch up when you do open it. That said, there are reasons to open the app. Inside you’ll find quests and challenges that unlock bonus Yucoin and there are Duolingo-esque events (called surges) that happen throughout the year.

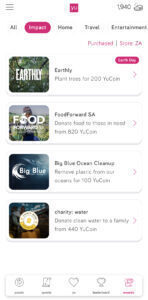

The app also has a leaderboard where you can compete with your colleagues and go head-to-head in Yucoin duels. So, what’s the point? Like other life insurance incentive programs, Yucoin can be exchanged for vouchers and product discounts. The rewards portal already has a number of well-known brands (NetFlorist, Engen, Mugg & Bean, Dis-Chem, Checkers, Poetry, etc.) where you can redeem the virtual currency for rewards. There are also a number of impact partners like Earthly, FoodForward SA, Big Blue Ocean Cleanup, and charity:water if you’re happy to donate them to charity. What makes YuLife different is that there are no complicated processes to claim anything, all you need to do is tap on the project and tap again to, for example, plant trees. It’s simple.

You do Yu

It’s easy to forget that YuLife is a life insurance app and that the more financial protection you have in place, the more you’ll get rewarded. “The app is more the interface to provide us the happy path of life, the path that will lead us to living our best lives,” says Marks. “The idea is to improve the accessibility of these financial products to enhance people’s well-being.”

Looking at the human resources (HR) portal, it’s easy to see the benefits that a company running YuLife can access. While you do have access to employee data, you also have the opportunity to enrich the lives of your staff by integrating systems, events, and critical health and wellbeing services like virtual doctor or nurse services, mental health support, online will-writing through QuickWill, etc.

Ultimately, YuLife works because while there are other insurance providers out there that offer incentives, they’re complicated to use, and rewards are only available to those who have managed to crack the system. Often, there are great benefits available but they’re not put to use because discovering that they’re there is as complex as deciding what life insurance policy to buy. “It’s about creating healthy habits for everyone, not just for the top 20%,” explains Sammy Rubin, the founder, and CEO of YuLife. “We see how well-being programs are just focused on the top 20%. It’s very nice. They can afford the more expensive gyms or mental health tools but what about everyone else? That’s where we believe YuLife comes in. We offer this experience to every employee. Every employee can be rewarded through these very simple actions and by consuming credits.” For Rubin, YuLife is not about exclusivity, he wants entire workforces to benefit – and be rewarded. “It’s not just focused on loving one part of the community, we want everyone to have access to this energy,” says Rubin.

Life-enhancing experiences for every employee

And it’s working. In the UK, YuLife is part of over 1,000 companies with more than 600,000 members using the YuLife app with the total value of coverage sitting at over $50 billion. According to statistics based on YuLife’s company data, 85% of the app users report being more productive, and 87% report more happiness.

“We see the real impact it’s having on businesses,” says Rubin. “We have opened up a whole world of wellbeing… where through the YuLife program, employees can utilize these programs and get rewarded for early intervention. It’s a win-win. Yugi is coming back to Africa. This is where we want to bring the magic and the love and the inspiration to build a new life insurance model that will shape the lives of millions of people and generations to come.”