October has seen South African payments fintech, Payflex signing up with Raru, offering the online tech and gaming retailer’s customers more flexibility when shopping products online.

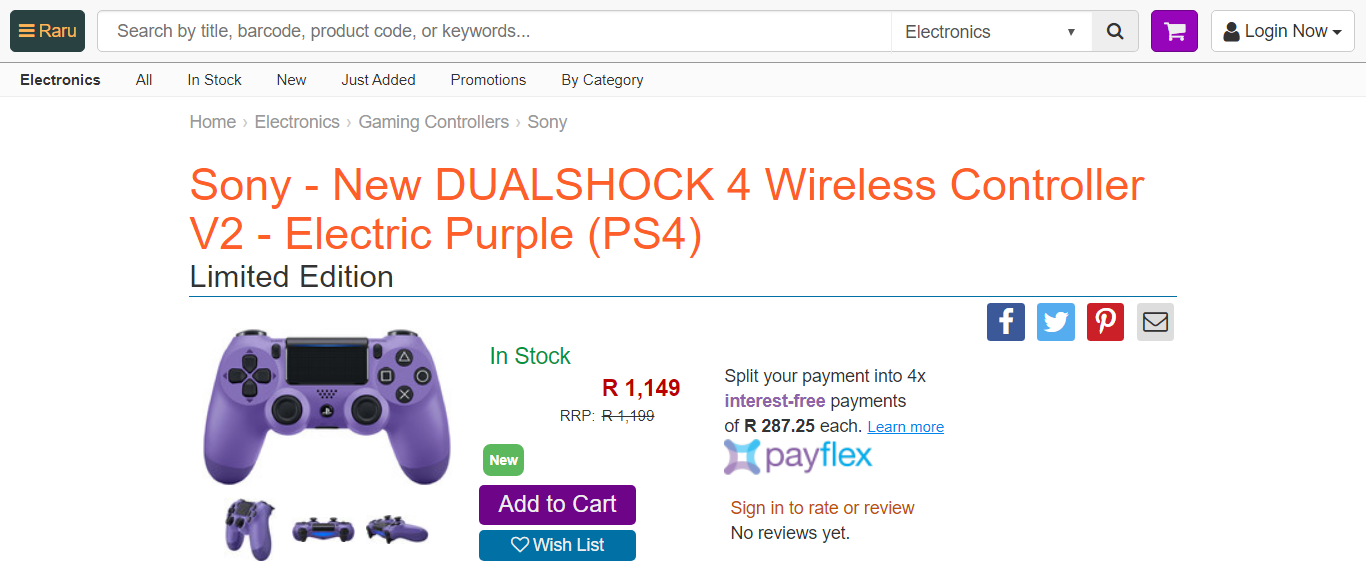

The new payment option enables Raru shoppers to enjoy the convenience of the Payflex shop-now pay-later offering, paying for their purchase in 4 equal payments spanning 6 weeks without incurring any extra costs: Zero interest. Zero fees. Zero catch.

“We are delighted to bring a flexible payment solution to our customers and offer shoppers cutting edge technology which adds to their online experience,” says Neil Smith, co-founder of Raru whose products extend beyond gaming to offer a wide selection of popular items from technology and hobbies to books, pet products, music, stationery, toys and even items for the hobby enthusiast.

“From Raru’s wireless headsets, monitors to the latest Lego set, DVDs and beyond, Payflex will empower Raru.co.za customers to flex the way they pay, with a choice of either an immediate, once-off payment or a simple, cost-effective shop-now pay-later option which spans 2 paychecks. We look forward to building this partnership and optimising the Raru shopping environment,” says Derek Cikes, Commercial Director at Payflex.

“From Raru’s wireless headsets, monitors to the latest Lego set, DVDs and beyond, Payflex will empower Raru.co.za customers to flex the way they pay, with a choice of either an immediate, once-off payment or a simple, cost-effective shop-now pay-later option which spans 2 paychecks. We look forward to building this partnership and optimising the Raru shopping environment,” says Derek Cikes, Commercial Director at Payflex.

“Raru prides itself in providing a faster and smarter shopping experience, making this a natural choice in entering into a partnership with a leading payments fintech which shares our passion and values of customer-centric service,” says Smith.

Payflex does just that, providing an easy to apply sign up service. This accesses an instant and seamless shopping experience, enhanced by a 1-click option to create a hassle-free online experience.

“With Black Friday on the horizon and the upcoming holidays, Payflex will partner Raru shoppers in getting their desired items or gifts while giving them peace of mind with a free spending plan which enables enjoyment of their lifestyle choices,” concludes Cikes.