There was a time when most people would have thought the acronym VOD was a contraction of Vodacom. Instead, it stands for video-on-demand, a hereto unremarkable section of the broadcast and internet industries that is suddenly enjoying a rush of interest from local and international players.

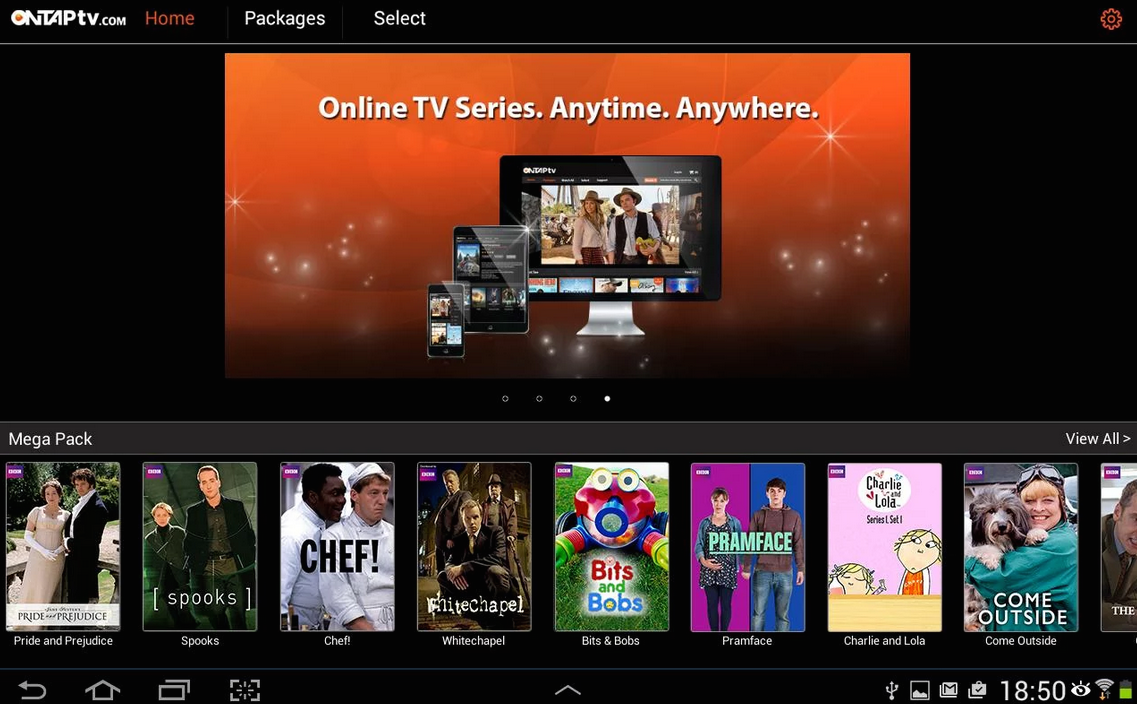

Last week another major international player announced it was opening up in South Africa. PCCW Global launched itsONTAPtv.com service, which offers a much more varied offering than the usual all-you-can-eat bundle. PCCW Global is itself owned by HKT, the biggest telecoms operator in Hong Kong.

Video-on-demand is a new entertainment possibility for broadband-starved South Africans, but it is common fare around the world where the installation of next-generation of fibre networks enables video-rich internet services like streaming.

With fibre suddenly the hot new thing in South Africa and numerous initiatives from a range of internet service providers, including a seemingly reenergised Telkom, these streaming services – also called over-the-top (OTT) players – have the big broadband pipe needed for video streaming.

ShowMax has attracted global media attention because of Naspers clout has as an emerging market media giant, through its one-third ownership of Chinese internet giant Tencent, which itself owns messaging apps WeChat and QQ.

Like Netflix, ShowMax has a set monthly fee for unlimited viewing – offering 11 000 hours of TV shows and movies, including a wealth of old SABC series and shows from DStv for R99 per month. Interestingly, ShowMax is an entirely separate company to MultiChoice, showing that Naspers has realised it needs to disrupt its own dominant satellite-based DStv offering before other streaming services do.

I’m very bullish on ShowMax’s chances – and global ambitions, even if it isn’t saying so itself – because of the calibre of its staff and the institutional knowledge in the DStv building about producing and securing the appropriate content for the South African market.

Interestingly, ONTAPtv.com offers an à la carte choice of content, allowing you to buy a single movie (R15) or viewing packages starting from R39 a month. It has cleverly secured local content – which any modern media mogul can tell you is the key to capturing new markets. It also cleverly offers the option to download movies or shows to smartphone or tablet apps, meaning someone can download a large file at work or using free wifi, then consume it at home while escaping the prohibitive cost of cellular data fees.

Streaming services offer older content and what the industry calls the “back catalogue”. All those old episodes of Game of Thrones or The Simpsons are waiting for consumers to watch. But what a lot of new Netflix users quickly discover is that the old content is all old. It’s great to catching up on series you’ve missed, but popular show Suits only debuts on Netflix after its been on its primary and syndicated TV networks.

Streaming services are what the broadcast industry calls second or third windows, or the second or third opportunity for content producers to sell their shows.

Subscription services like DStv will always be the place to catch the news and sports channels, and anything current. The reason is simple. Producing content costs and costs a lot. This is especially true of news and sports, which have massive production crews and distribution costs.

This is not the case with other content, as Netflix has shown with first-class series like House of Cards and Orange Is The New Black, which have both won numerous awards, while normalising the binge viewing that is now a default way of watching TV series.

Like all competition, the rush of streaming service is good for South African consumers.