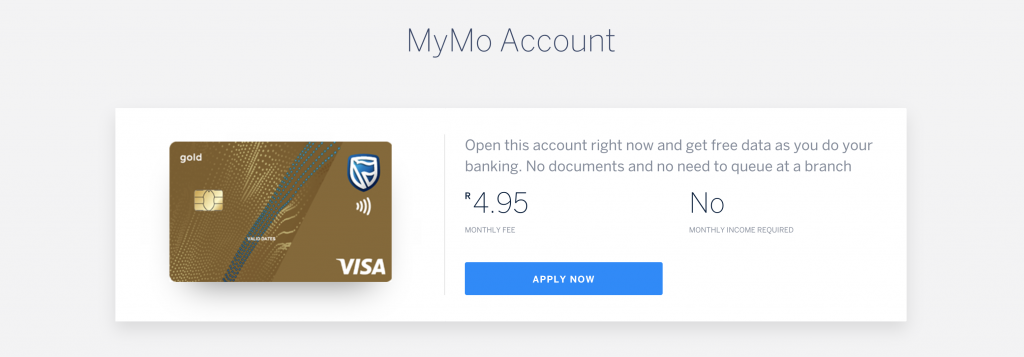

Standard Bank has launched a new transactional bank account called MyMo that has a base, monthly fee of R4.95/month and includes a Standard Bank Mobile SIM card with R50 of airtime or data each month. Would-be customers don’t need any regular income to open an account but do need to be 18 years or over and have a South African ID or ID smart card.

MyMo is a pay-per-transaction account for now, although the bank says it’s considering bundled options in future. Customers wanting to take advantage of the SIM card will be able to port their existing mobile number. Standard Bank’s mobile virtual network operator (MVNO) piggybacks on Cell C’s mobile network. The bank has hinted it’ll soon be offering MyMo customers the option to purchase mobile devices, but won’t be drawn on the specifics.

Say cheese

New customers can open a MyMo account from the Standard Bank mobile app and can verify their identity by means of a selfie that is cross-referenced with the Department of Home Affairs’ database. Customers can also open an account via Standard Bank’s website, or by (heaven forbid) going into a branch.

Existing Standard Bank customers can’t change their account to a MyMo one, but the bank says it is looking at enabling this option in future. The service is live and consumers can sign up today.

Existing Standard Bank customers can’t change their account to a MyMo one, but the bank says it is looking at enabling this option in future. The service is live and consumers can sign up today.

Bafflingly for a digitally-focused solution, customers will have to go into a Standard Bank branch to collect their MyMo card, but the bank says it’s working to add card deliveries soon.

In addition to the monthly fee, customers are charged a flat-rate of R1/month or SMS notifications about account activity, ATM withdrawals start at R6.50/withdrawal, in-store cash withdrawals start at R1.40. Debit orders, meanwhile, cost R3.50 and card swipes are free. Head over here for a full breakdown of the associated fees.

(UPDATE: Standard Bank this afternoon put out a media release with more information about MyMo. According to it, in order to qualify for the free airtime or data a MyMo customer has to swipe their MyMo card more than four times a month. Also, for every R20 spent on the card, an addition 1MB will be loaded to the users SIM).