Being fiscally responsible is much easier today thanks to smartphone apps that help you to budget your money and manage your expenses. This is doubly applicable to your small business, which lives or dies based on how well you manage your money.

Here are five to help with fiscal responsibility that you can check out right now.

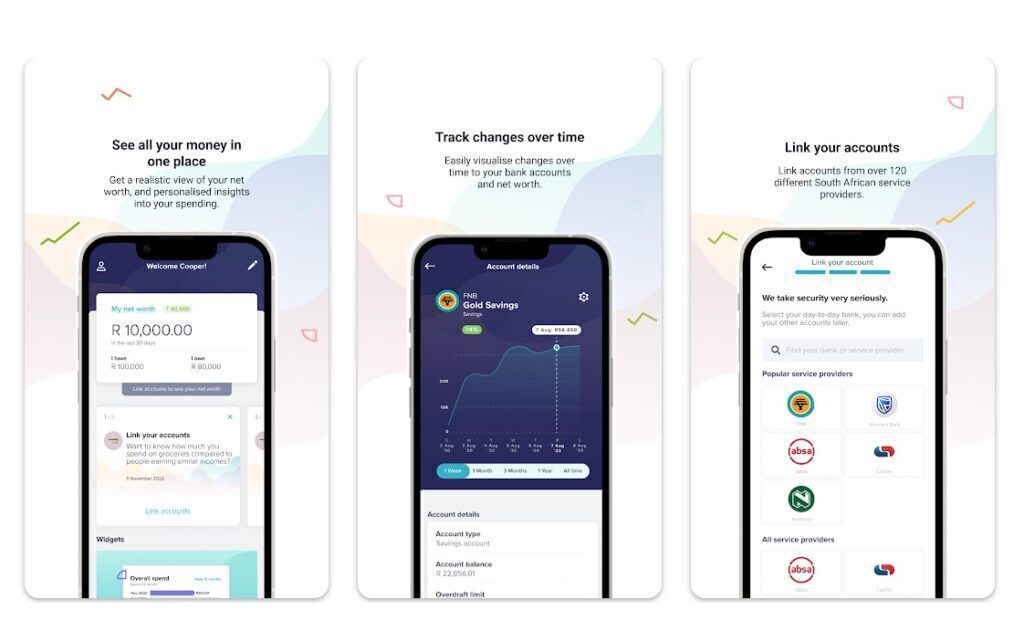

22Seven

3.6 Stars, 3k reviews, free to use

This homegrown budgeting app is made by South Africans, for South Africans, and is backed by Old Mutual, so you know your information and money are safe.

22Seven does its level best to examine all of your financial information and provide you with insights into your spending habits to potentially help you to budget better and save money in the long term.

It asks that you link all of your “money stuff” to the app. These are your cheque and savings accounts, credit and store accounts, store cards, investments, loans, and rewards. It then sorts them into categories and tracks what you spend and when to show you where your money goes every month. It warns that “…it’s honest about what you do with your money”, so prepare to have your spending laid bare.

User feedback on this one is a mixed bag; while they are quite positive on the 22Seven website, the most recent feedback from users on the Google Play Store shows that the development team has changed some things and moved others around in recent updates, which some people don’t like.

For all intents and purposes, though, 22Seven is probably the budgeting/expense app to go with as it’s 100% relevant to the South African context, which some of the other apps here aren’t.

Spending Tracker

4.6 Stars, 57k reviews

This is a very simple app for tracking your salary versus your expenses. It has an uncomplicated but attractive interface, and basically asks you to manually enter your income and expenses so it can give you an at-a-glance report as to how much money you have left for the month.

When you enter your income and expenses, you can choose from pre-existing categories or add your own. It takes a bit of setting up initially by manually entering your salary and your set monthly expenses, but once that’s done you just need to enter any out-of-the-ordinary expenses as you incur them to see an accurate view of your money situation.

This is probably the simplest way to do some basic tracking of your base financial state. It does exactly what it says it does, without being overly complicated.

GoodBudget

4.4 Stars, 18k reviews

GoodBudget takes an old-timey approach to budgeting, by offering the user different “envelopes” into which they can allocate their monthly expenses. A century ago, people in New York were apparently cashing their salaries and stuffing physical envelopes with it. Each envelope represented an expense, and the amount of money stuffed inside each one was the amount allocated to that expense. If they reached the end of the month with money still in any of their envelopes, they had stuck to their budget.

GoodBudget does the same thing, except digitally on your phone. The free version gives users access to ten envelopes that they can allocate as expenses. Users tell the app how much they earn, and set an amount for each expense. As the month goes on, they enter transactions under each envelope indicating the money they have spent on each expense. This lets them closely monitor their spending, and GoodBudget’s reports let them gain insights into their spending.

The problem with GoodBudget is that while it’s actually pretty decent at what it does, only giving people ten envelopes to work with in the free version isn’t enough. Sure, paying fixes the problem, but it’s annoying nonetheless that the free version is only of limited use.

Only get this if you have fewer than ten expense categories every month, or you’re willing to pay for premium features.

Wallet

4.6 Stars, 279k reviews

Wallet aims to help you manage your finances, monitor spending, and offers advice on how you can improve your money management, all from your phone.

It syncs with more than 15,000 banks around the world, and once synced Wallet will automatically populate the app with your transactions. You will need to pay for this, however, as it’s not available in the free version. If you’re down with entering your information manually, you can still get plenty of use out of Wallet.

Using the app is easy thanks to a clean and intuitive interface, but you will need to manually sync your bank account with it on occasion (this is a challenge with all budget apps that integrate with your bank account, apparently). The visualisations it offers are excellent, and regular use of the app should help anyone interested in budgeting and tracking where their money goes to do a better job of it.

Buxfer

3.6 Stars, 727 reviews

If you’re looking for a comprehensive expense-tracking app that gives you a complete picture of your financial situation, Buxfer is a great option. Firstly, it supports all South African banks, which is good because it asks you to connect your bank accounts to it so it can download your transaction data and give you a real-time look at your money.

Second, it offers a comprehensive dashboard overview of your finances, including things like the value of your home (if you’re an owner), your investments, savings, and cash on hand. You’ll need to put some of those figures in manually (there’s no way for Buxfer to know how much cash is in your wallet, for example), but once you do, you’ll have access to a detailed view of where you are, financially.

Buxfer is both a smartphone app and a website, and both are easy to use. The website offers a demo that shows you what your data will look like once you’ve linked your accounts to Buxfer, so check that out if you want to see more before committing.