Late last year, rumours turned up concerning DStv Flex. First reported by Thinus Ferreira, a South African entertainment reporter, the service was supposed to allow DStv subscribers to pick and choose a little more than it does now.

Since then, there’s been little movement. Queries to DStv owner Multichoice over the existence of Flex were met with the same response as last year.

“MultiChoice is constantly striving to provide its customers with the best possible content offering. As such, we continually assess our offering and conduct regular research to test different products and services for our customers.”

Weird Flex, but okay

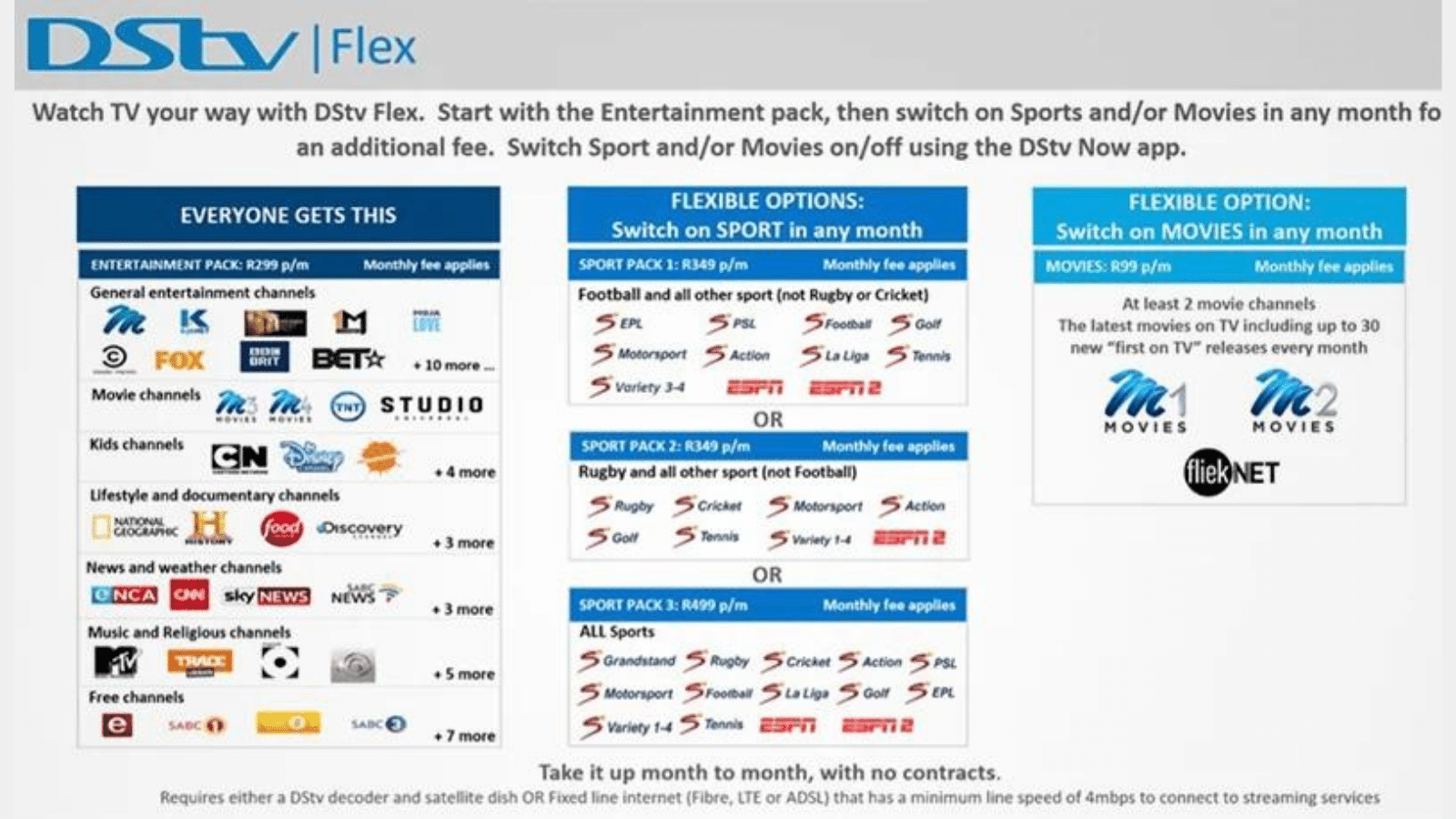

Odds are you even know exactly why DStv Flex wouldn’t do a thing to change DStv’s current trajectory. The answer is sport. It’s always been sport. And the planned (rumoured) package structure for DStv Flex doesn’t let subscribers choose only sport. The entertainment package must be taken. That’s a R300/m subscription fee, which is the same as Disney+ and a decent Netflix sub. Between those two services, all of your entertainment needs are rather fully met. The news and religious channels are just as easy to find, free of charge, on YouTube. Also, we’re pretty sure you’re not supposed to charge for access to Jesus. They had a Reformation about it and everything.

South African time

One of the reliable things you can say about South Africa is that things happen slower here. Once upon a time, we were the dumping ground for almost obsolete technology. That bit has changed, but our industries in general move a little slower. We’re still heavily reliant on coal, for example. And our telecommunications industry is dismally slow. As such, we’re seeing international trends that have been rolling for nigh-on a decade finally hit their stride now.

Cord-cutting is an American phenomenon that saw Cable subscribers (like DStv, but with a literal cable) chucking their subscriptions. The major holdouts were sports fans, who just couldn’t get that coverage anywhere else. But things have started to change. Providers like Multichoice, and all those lovely American folks who went through this first, spent a long time riveting subscribers by tying access to sports to a subscription to… channels that nobody watches.

South Africa is catching up here. Cord-cutting, in the form of dropping a DStv subscription, is on the increase. Multichoice is looking for ways to prevent a stream of lost subscribers from turning into a river. DStv Flex is one of those ways. But it is tailored to keep DStv running the same way it always has. It counts on South African subscribers opting just to watch sports in certain months and being okay with paying for that access, on top of a bunch of content they don’t really care about.

Unbundling the future

Gated sports access has been used to prop up entertainment channels that have loads of competition from far superior services. After all, if you’re scoring almost R10k per subscriber a year, and all that subscriber wants is access to the sports channel, then you’re losing loads of cash. That cash is typically spent for the sports licensing, but also on licensing all the other channels on the service. You know, the ones barely anyone with a streaming subscription is watching?

Unbundled sports packages are a nightmare for any paid television provider. Sports is the hook. It’s the one thing that streaming services don’t have. Well, it used to be. But if DStv Flex launches with the ability to only pay for sport, that’s what a significant bunch of subscribers will do. Accounts will downgrade, and the entertainment channels with their lovely advertising will go unwatched. It’s not hard to see why Multichoice doesn’t want that to happen. But it’s also not considering how many new subscribers will tune in for more affordable, sport-only packages.

The sound of inevitability

Or perhaps it is. This situation — which is coming whether traditional broadcasters want it or not — calls for a massive change in how companies like Multichoice do business. Sports can’t subsidise sub-standard content and plentiful licenses in a world where streaming exists. Individual sports are increasingly turning to their own streaming platforms in a bid to keep fans engaged. Eventually, DStv and services like it will have to try unbundled sports packages, while jettisoning the dross.

But waiting too long will mean that any changes are pointless. DStv Flex — the idea of it — is more or less right. The implementation, if it ever kicks in, is considerably less so. Streaming services offer convenience, more than anything else, and that’s where companies like Multichoice have to compete. Entertainment-only packages for the movie nuts. Sports-only for the sports fans. But forcing the second to pay for the first only leads to resentment, and an immediate ship-jump the moment Rugby: The Streaming Service™ comes along.